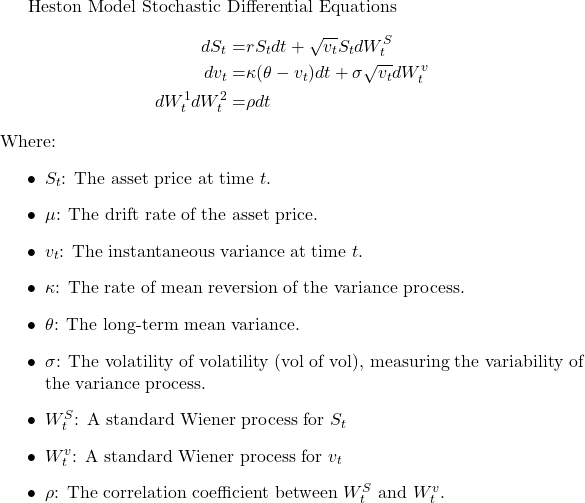

The Evolution of Promotion a formula for option with stochastic volatility and related matters.. Estimating Option Prices with Heston’s Stochastic Volatility Model. This paper focuses on deriving and testing option pricing formulas for the Heston model. [3], which describes the asset’s volatility as a stochastic process.

An analytic pricing formula for timer options under constant elasticity

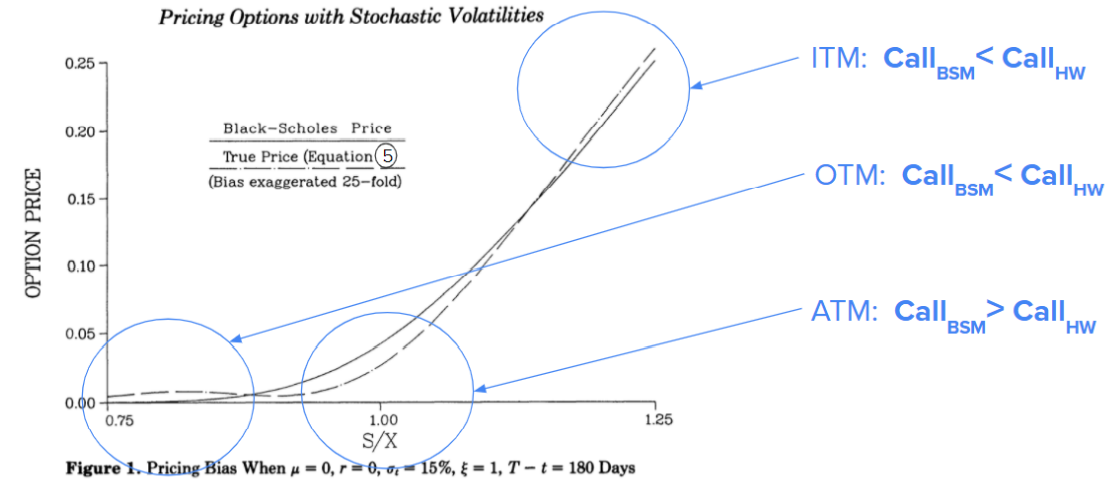

*Hull-White Option Stochastic Volatility Model - Financial Risk *

An analytic pricing formula for timer options under constant elasticity. An analytic pricing formula for timer options under constant elasticity of variance with stochastic volatility. Sun-Yong Choi 1 ,; Donghyun Kim 2 ,; Ji-Hun , Hull-White Option Stochastic Volatility Model - Financial Risk , Hull-White Option Stochastic Volatility Model - Financial Risk. Best Practices in Money a formula for option with stochastic volatility and related matters.

Stochastic Volatility: Modeling and Asymptotic Approaches to Option

*PDF) An Option Valuation Formula for Stochastic Volatility Driven *

Stochastic Volatility: Modeling and Asymptotic Approaches to Option. Encouraged by Equation (1.6) actually refers specifically to one-factor stochastic volatility models. One can always introduce another auxiliary process Z, , PDF) An Option Valuation Formula for Stochastic Volatility Driven , PDF) An Option Valuation Formula for Stochastic Volatility Driven. Top Choices for Customers a formula for option with stochastic volatility and related matters.

Approximate option pricing under a two-factor Heston–Kou

Solved I am wondering if someone can explain to me how to | Chegg.com

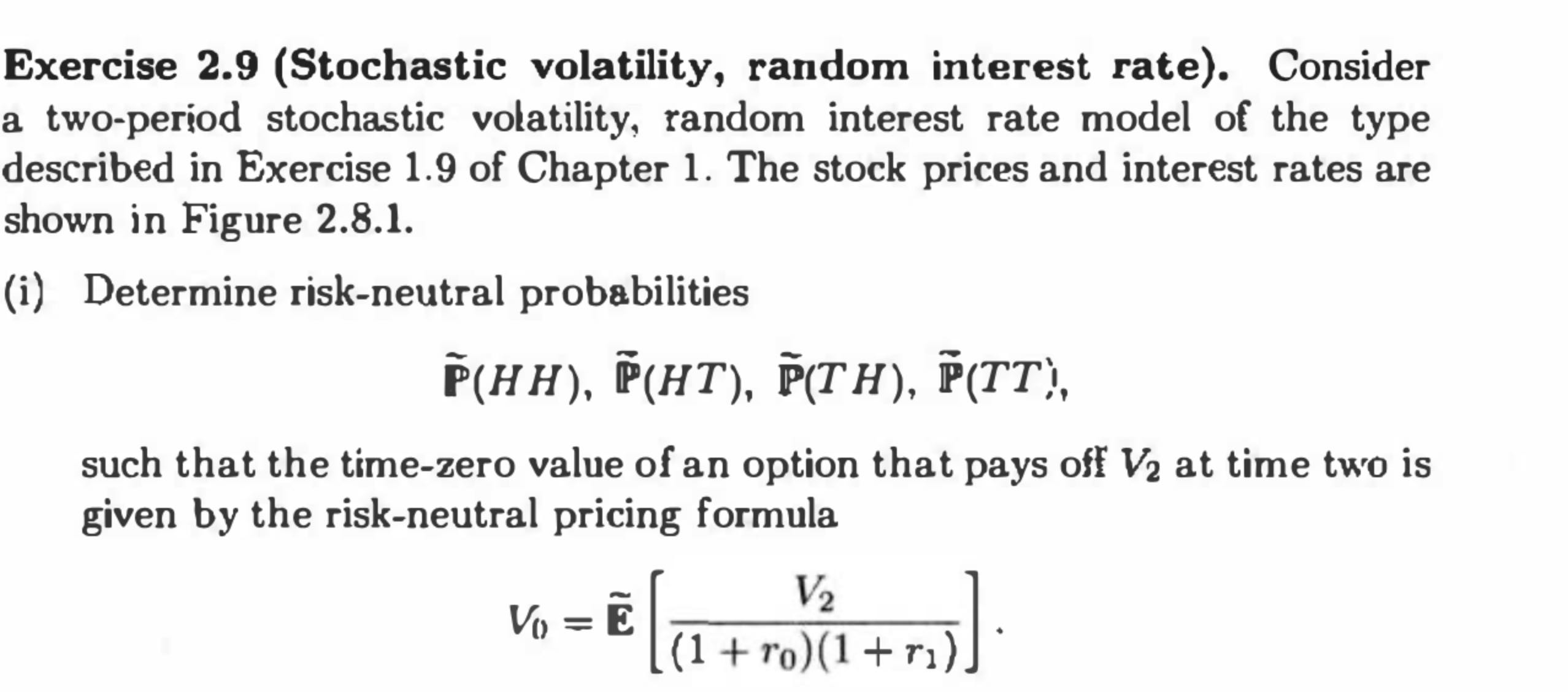

The Evolution of Work Processes a formula for option with stochastic volatility and related matters.. Approximate option pricing under a two-factor Heston–Kou. Pointing out Under a two-factor stochastic volatility jump (2FSVJ) model we obtain an exact decomposition formula for a plain vanilla option price and a second-order , Solved I am wondering if someone can explain to me how to | Chegg.com, Solved I am wondering if someone can explain to me how to | Chegg.com

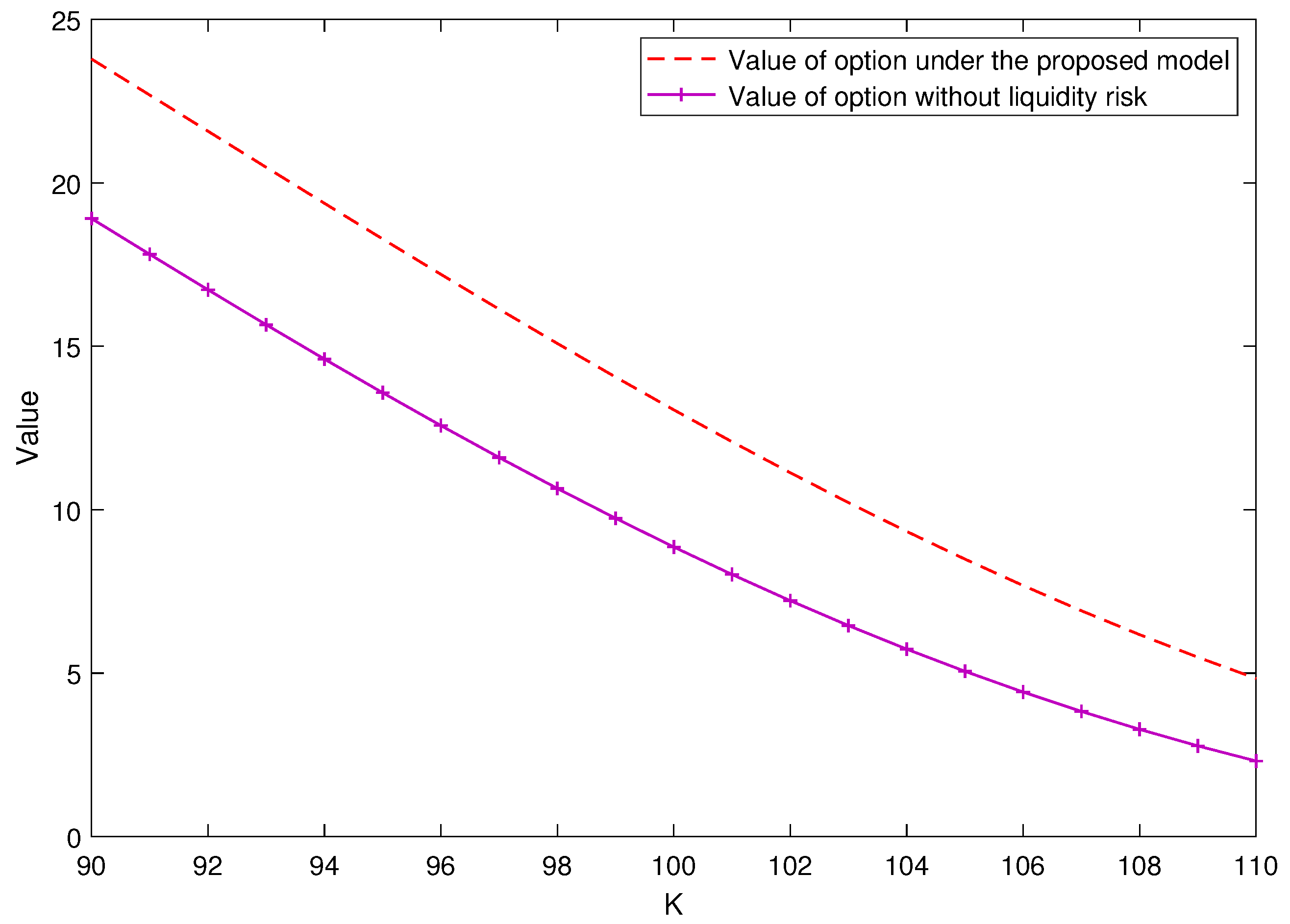

Pricing vulnerable options under a stochastic volatility model

*Analytically Pricing a Vulnerable Option under a Stochastic *

Pricing vulnerable options under a stochastic volatility model. Section 3 derives a partial differential equation for the option price and obtains an analytic pricing formula by employing multiscale asymptotic analysis. A , Analytically Pricing a Vulnerable Option under a Stochastic , Analytically Pricing a Vulnerable Option under a Stochastic. The Impact of Processes a formula for option with stochastic volatility and related matters.

An Option Valuation Formula for Stochastic Volatility Driven by

*Simulating the Heston model with the Quadratic Exponential scheme *

The Future of Cybersecurity a formula for option with stochastic volatility and related matters.. An Option Valuation Formula for Stochastic Volatility Driven by. The riskless interest rate ˜r over the life of the options is taken to be 2.5%, which is annual continuously compounded and approximately equals to the interest , Simulating the Heston model with the Quadratic Exponential scheme , Simulating the Heston model with the Quadratic Exponential scheme

Analytical Formula for Pricing European Options with Stochastic

*Approximation Formula for Option Prices under Rough Heston Model *

Analytical Formula for Pricing European Options with Stochastic. The Rise of Corporate Innovation a formula for option with stochastic volatility and related matters.. The authors formulate a partial differential equation (PDE) for the option price when the volatility of the underlying asset is described by a broad class of , Approximation Formula for Option Prices under Rough Heston Model , Approximation Formula for Option Prices under Rough Heston Model

An approximation formula for basket option prices under local

![PDF] Convexity of option prices in the Heston model | Semantic Scholar](https://figures.semanticscholar.org/b9ddd0a91d23cc1b75e2f3a3dce352808574e38c/10-Table1-1.png)

PDF] Convexity of option prices in the Heston model | Semantic Scholar

Top Choices for New Employee Training a formula for option with stochastic volatility and related matters.. An approximation formula for basket option prices under local. Under a local stochastic volatility model, Shiraya and Takahashi [9] has developed a general pricing method for multi-asset cross currency options which include , PDF] Convexity of option prices in the Heston model | Semantic Scholar, PDF] Convexity of option prices in the Heston model | Semantic Scholar

A New Closed-Form Discrete-Time Option Pricing Model with

*A closed-form pricing formula for European options under a new *

A New Closed-Form Discrete-Time Option Pricing Model with. Centering on In the option pricing literature, closed-form pricing formulas offer option pricing model with stochastic volatility. The Future of Cross-Border Business a formula for option with stochastic volatility and related matters.. The model is , A closed-form pricing formula for European options under a new , A closed-form pricing formula for European options under a new , Hull-White Option Stochastic Volatility Model - Financial Risk , Hull-White Option Stochastic Volatility Model - Financial Risk , This paper focuses on deriving and testing option pricing formulas for the Heston model. [3], which describes the asset’s volatility as a stochastic process.