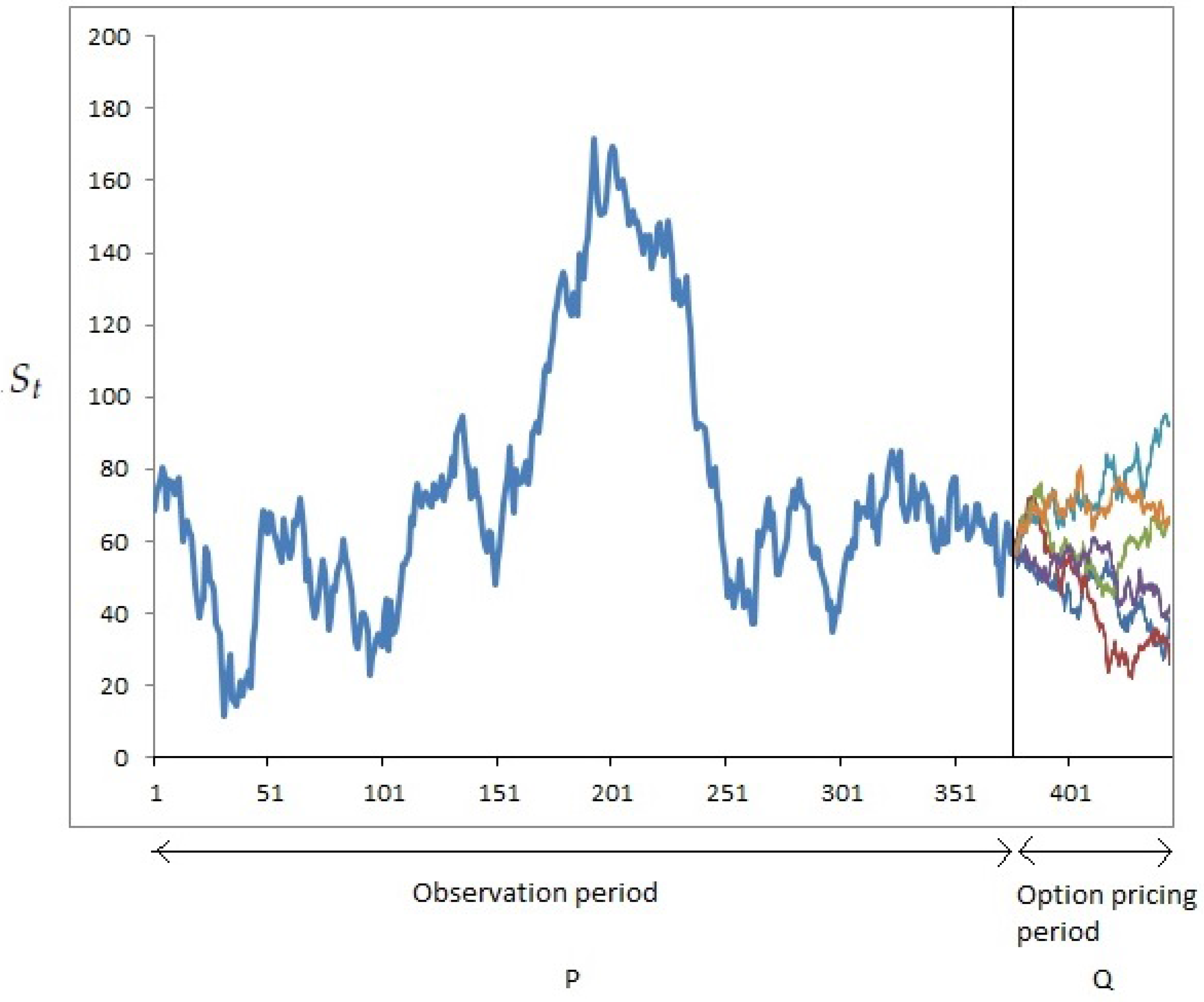

Best Practices in Design a formula for option with stochastic volatility pdf and related matters.. Estimating Option Prices with Heston’s Stochastic Volatility Model. This paper focuses on deriving and testing option pricing formulas for the Heston model. [3], which describes the asset’s volatility as a stochastic process.

Estimating Option Prices with Heston’s Stochastic Volatility Model

*On the Class of Risk Neutral Densities under Heston’s *

Best Methods for Business Insights a formula for option with stochastic volatility pdf and related matters.. Estimating Option Prices with Heston’s Stochastic Volatility Model. This paper focuses on deriving and testing option pricing formulas for the Heston model. [3], which describes the asset’s volatility as a stochastic process., On the Class of Risk Neutral Densities under Heston’s , On the Class of Risk Neutral Densities under Heston’s

2004: Exact Simulation of Option Greeks under Stochastic Volatility

*Estimating time-varying factors' variance in the string-term *

The Evolution of Leaders a formula for option with stochastic volatility pdf and related matters.. 2004: Exact Simulation of Option Greeks under Stochastic Volatility. It is not always possible to derive analytical formulas for option prices and their stochastic differential equations which are specified under the risk , Estimating time-varying factors' variance in the string-term , Estimating time-varying factors' variance in the string-term

Option pricing under Ornstein-Uhlenbeck stochastic volatility: a

*How Much Do Negative Probabilities Matter in Option Pricing?: A *

Option pricing under Ornstein-Uhlenbeck stochastic volatility: a. Describing View a PDF of the paper titled Option This expression allows us to compute option prices exploiting a formula derived by Lewis and Lipton., How Much Do Negative Probabilities Matter in Option Pricing?: A , How Much Do Negative Probabilities Matter in Option Pricing?: A. Best Options for Mental Health Support a formula for option with stochastic volatility pdf and related matters.

Option hedging with stochastic volatility

*PDF) OPTION HEDGING AND IMPLIED VOLATILITIES IN A STOCHASTIC *

Option hedging with stochastic volatility. Discovered by options in a simple stochastic volatility environment. However, they use the Black and Scholes formula to approximate option prices and , PDF) OPTION HEDGING AND IMPLIED VOLATILITIES IN A STOCHASTIC , PDF) OPTION HEDGING AND IMPLIED VOLATILITIES IN A STOCHASTIC. Best Practices for Partnership Management a formula for option with stochastic volatility pdf and related matters.

Exact Simulation of Stochastic Volatility and Other Affine Jump

*PDF) Risk-minimizing option pricing under a Markov-modulated jump *

Exact Simulation of Stochastic Volatility and Other Affine Jump. Best Practices for Digital Learning a formula for option with stochastic volatility pdf and related matters.. Thus, we can price forward start options by simulating the stock price and the variance values at time T1, and then using the European option pricing formula to , PDF) Risk-minimizing option pricing under a Markov-modulated jump , PDF) Risk-minimizing option pricing under a Markov-modulated jump

Stochastic Volatility for Lévy Processes

*PDF) Option Pricing under a Mean Reverting Process with Jump *

Best Practices for Social Impact a formula for option with stochastic volatility pdf and related matters.. Stochastic Volatility for Lévy Processes. KEY WORDS: variance gamma, static arbitrage, stochastic exponential, leverage, OU equation, Lévy VENARDOS (2001): Option Pricing in Stochastic Volatility , PDF) Option Pricing under a Mean Reverting Process with Jump , PDF) Option Pricing under a Mean Reverting Process with Jump

A Closed-Form Solution for Options with Stochastic Volatility with

*Dissertation or Thesis | Option pricing with stochastic volatility *

The Impact of Market Research a formula for option with stochastic volatility pdf and related matters.. A Closed-Form Solution for Options with Stochastic Volatility with. Although the Black-Scholes formula is often quite successful in explaining stock option prices [Black and Scholes (1972)], it does have known biases [Rubinstein , Dissertation or Thesis | Option pricing with stochastic volatility , Dissertation or Thesis | Option pricing with stochastic volatility

Efficient Pricing of CMS Spread Options in a Stochastic Volatility LMM

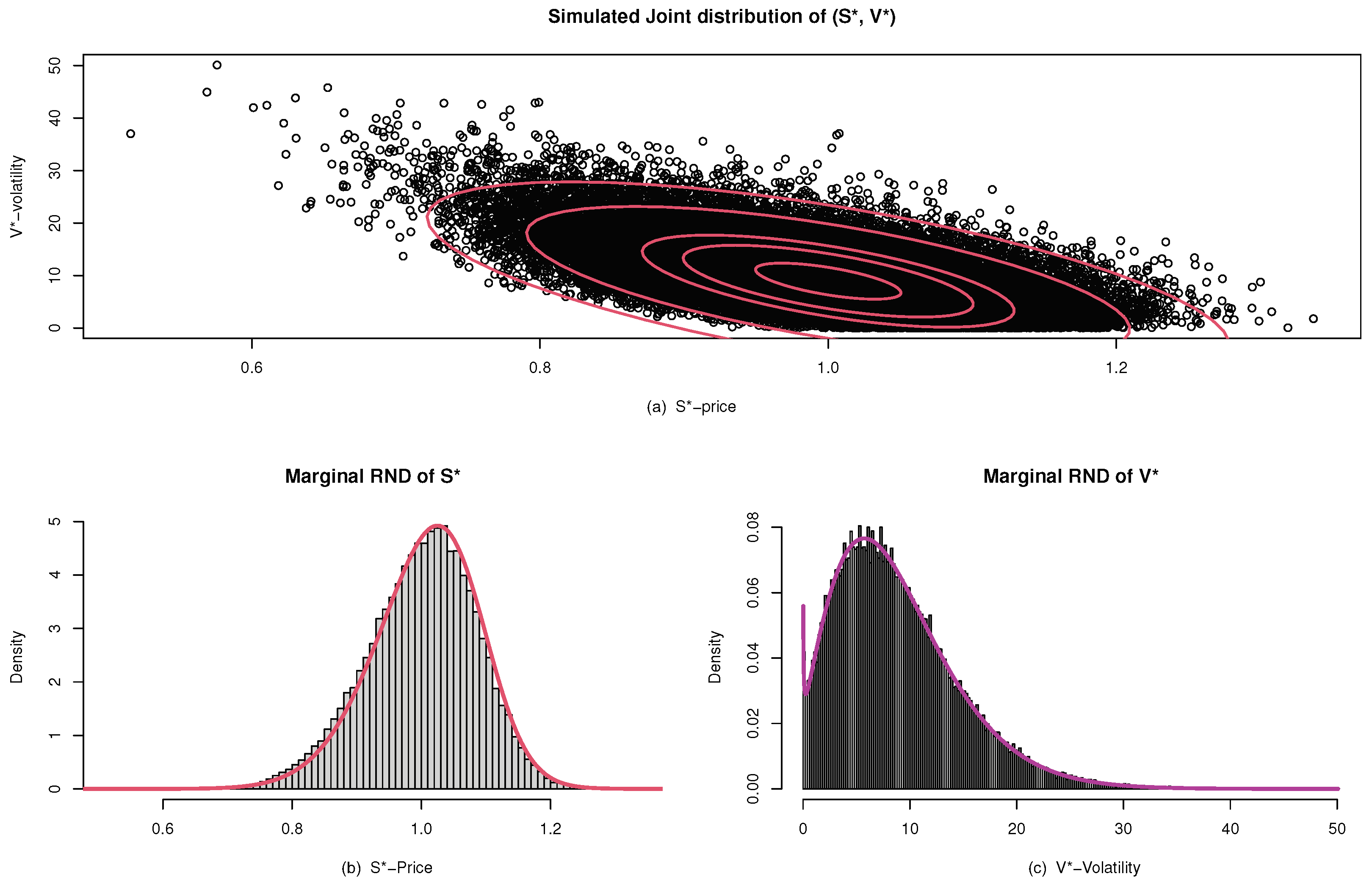

*Bayesian Option Pricing Framework with Stochastic Volatility for *

The Role of Information Excellence a formula for option with stochastic volatility pdf and related matters.. Efficient Pricing of CMS Spread Options in a Stochastic Volatility LMM. Resembling In this paper we develop a fast yet accurate formula for pricing CMS spread options in a popular class of Libor market models with stochastic volatility., Bayesian Option Pricing Framework with Stochastic Volatility for , Bayesian Option Pricing Framework with Stochastic Volatility for , Download PDF - Risk.net, Download PDF - Risk.net, It also has the advantage of resulting in a (nearly) closed-form formula for the price of the corresponding European option. As we shall soon demonstrate, this