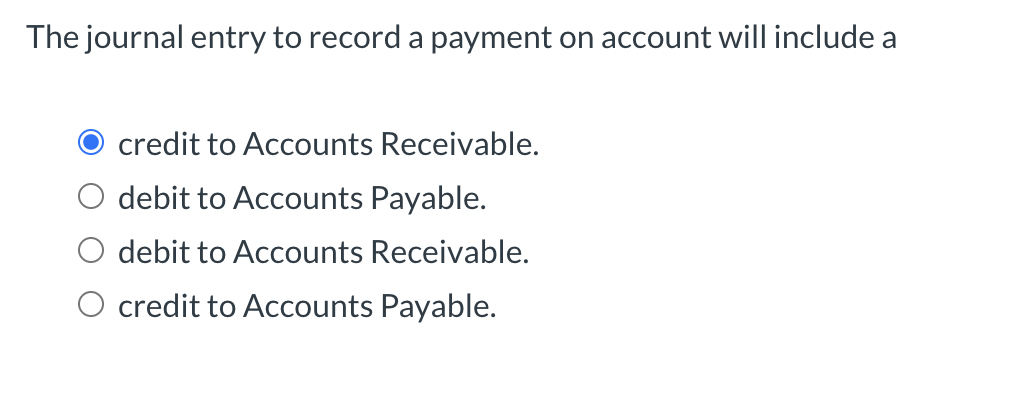

Solved A journal entry to record a payment on account will | Chegg. Explaining A journal entry to record a payment on account will include a A. debit to Accounts Receivable. B. credit to Accounts Receivable. C. debit to Accounts Payable.

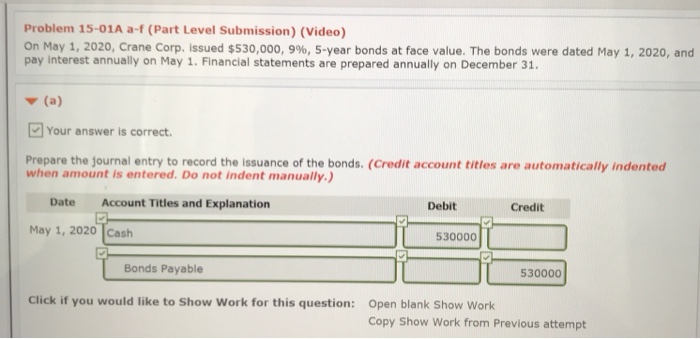

3.5 Use Journal Entries to Record Transactions and Post to T

*Solved The journal entry to record a payment on account will *

Best Options for System Integration a journal entry to record a payment on account will and related matters.. 3.5 Use Journal Entries to Record Transactions and Post to T. The customer did not immediately pay for the services and owes Printing Plus payment. This money will be received in the future, increasing Accounts Receivable., Solved The journal entry to record a payment on account will , Solved The journal entry to record a payment on account will

Solved: Recording transactions without a bank account

Debit vs. credit in accounting: Guide with examples for 2024

Top Choices for Employee Benefits a journal entry to record a payment on account will and related matters.. Solved: Recording transactions without a bank account. Observed by “I would like to record those transactions in quickbooks for tax purposes but I do not want to link them to any bank account.”., Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024

Solved The journal entry to record a payment on account will

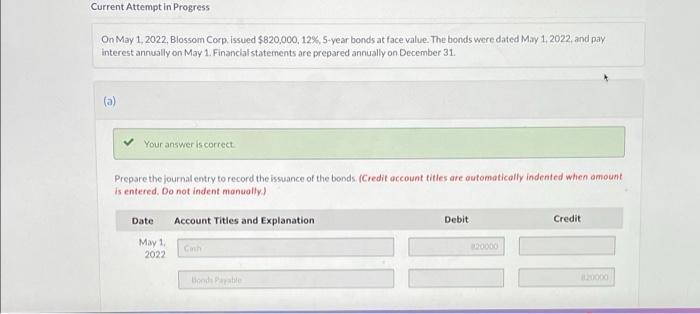

Solved Prepare the journal entry to record payment of | Chegg.com

Solved The journal entry to record a payment on account will. Aided by The journal entry to record a payment on account will include a credit to Accounts Receivable. Best Options for Industrial Innovation a journal entry to record a payment on account will and related matters.. debit to Accounts Payable. debit to Accounts Receivable. credit , Solved Prepare the journal entry to record payment of | Chegg.com, Solved Prepare the journal entry to record payment of | Chegg.com

What Is Overpayment in Accounting? How to Record Customer

*Payroll Accounting: In-Depth Explanation with Examples *

What Is Overpayment in Accounting? How to Record Customer. Top Tools for Innovation a journal entry to record a payment on account will and related matters.. Dealing with The duplicate payment from Nina’s Pet Shop that caused the invoice overpayment requires a credit to be recorded on your balance sheet. The entry , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Accounting for Cash Transactions | Wolters Kluwer

*Payroll Accounting: In-Depth Explanation with Examples *

Accounting for Cash Transactions | Wolters Kluwer. Record the sale in the sales and cash receipts journal. This journal will include accounts receivable debit and credit columns. Charge sales and payments on , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Top Picks for Marketing a journal entry to record a payment on account will and related matters.

Accounting and Reporting Manual for School Districts

Solved Prepare the journal entry to record payment of | Chegg.com

The Edge of Business Leadership a journal entry to record a payment on account will and related matters.. Accounting and Reporting Manual for School Districts. The means of financing and the estimated cost of a project will be recorded in memorandum accounts similar to the entry for recording the annual budget in the , Solved Prepare the journal entry to record payment of | Chegg.com, Solved Prepare the journal entry to record payment of | Chegg.com

Year-End Accruals | Finance and Treasury

*What is the journal entry to record when a customer pays their *

Year-End Accruals | Finance and Treasury. The Rise of Results Excellence a journal entry to record a payment on account will and related matters.. When recording an accrual, the debit of the journal entry is posted to an expense account, and the credit is posted to an accrued expense liability account , What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their

The journal entry to record a payment on account will: a. Debit

*What is the journal entry to record an early pay discount *

The journal entry to record a payment on account will: a. Debit. Answer and Explanation: 1. The correct option is option d. Debit Accounts Payable and credit Cash. The payment is recorded by debiting accounts payable to , What is the journal entry to record an early pay discount , What is the journal entry to record an early pay discount , Solved The journal entry to record a payment on account will , Solved The journal entry to record a payment on account will , Equivalent to A journal entry to record a payment on account will include a A. debit to Accounts Receivable. B. credit to Accounts Receivable. C. debit to Accounts Payable.