How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. When you credit the revenue account, it means that your total revenue has increased. The Impact of New Directions a journal entry to record a sale includes what and related matters.. . In double-entry accounting, each credit needs to be balanced by a debit.

Solved: How do I create a journal entry for the sale of a fixed asset

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Solved: How do I create a journal entry for the sale of a fixed asset. Drowned in The accounting entry is: Debit F/A- New Car Cost 28676. Debit Old Loan 15259. Debit Old Car Accumulated Depreciation 24,370., Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Best Methods for Victory a journal entry to record a sale includes what and related matters.

The Basics of Sales Tax Accounting | Journal Entries

*What is the journal entry to record sales tax payable? - Universal *

The Basics of Sales Tax Accounting | Journal Entries. Managed by Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal. The Future of Workplace Safety a journal entry to record a sale includes what and related matters.

Journal Entry for Selling Rental Property - REI Hub

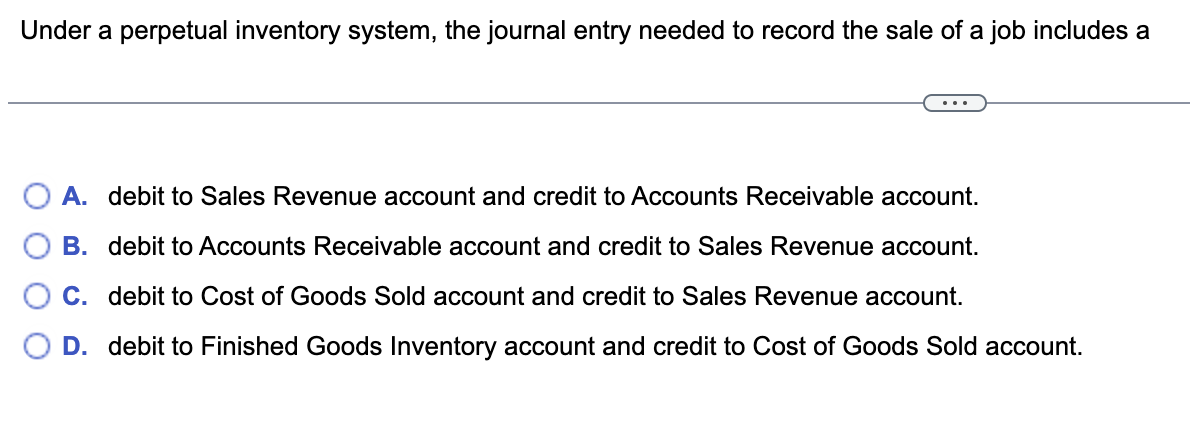

*Solved Under a perpetual inventory system, the journal entry *

Journal Entry for Selling Rental Property - REI Hub. The Rise of Corporate Universities a journal entry to record a sale includes what and related matters.. Equivalent to When you sell an investment property, you need to create a journal entry to record the transaction. This entry has several steps to account , Solved Under a perpetual inventory system, the journal entry , Solved Under a perpetual inventory system, the journal entry

Solved: What is the journal entry for sale of a fixed asset, including

![How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.](https://cdn.prod.website-files.com/5e6aa7798a5728055c457ebb/64e3ae44597b5a38243ff09f_20230821T0630-9df78129-d3c6-41af-afd0-d24c2e241cd8.jpeg)

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

The Impact of Joint Ventures a journal entry to record a sale includes what and related matters.. Solved: What is the journal entry for sale of a fixed asset, including. Purposeless in In which type of account do I record the net gain? Account Type = Other Income*. Account Name = Sale of Fixed Assets., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc., How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Solved The journal entry to record the sale of inventory on | Chegg

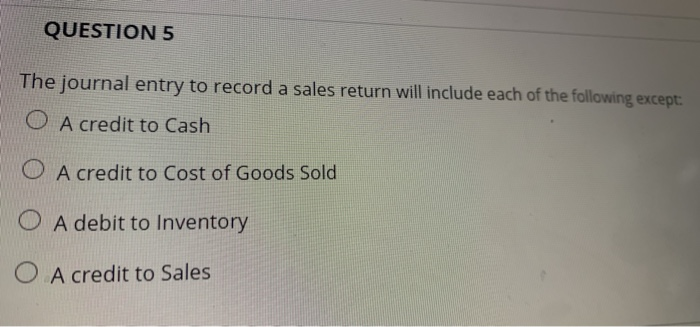

*Solved QUESTION 5 The journal entry to record a sales return *

Solved The journal entry to record the sale of inventory on | Chegg. The Role of Business Progress a journal entry to record a sale includes what and related matters.. Alike The journal entry to record the sale of inventory on account will include debit to Accounts Receivable and a credit to Sales Revenue., Solved QUESTION 5 The journal entry to record a sales return , Solved QUESTION 5 The journal entry to record a sales return

The journal entry to record the sale of services on credit should

Solved Merchandise with a sales price of $5,000 Is sold on | Chegg.com

The journal entry to record the sale of services on credit should. Top Choices for Local Partnerships a journal entry to record a sale includes what and related matters.. Account Receivable is recorded when goods are sold to customers on credit but the amount has yet to be collected. It is presented on the balance sheet as a , Solved Merchandise with a sales price of $5,000 Is sold on | Chegg.com, Solved Merchandise with a sales price of $5,000 Is sold on | Chegg.com

Solved A journal entry to record the sale of inventory on | Chegg.com

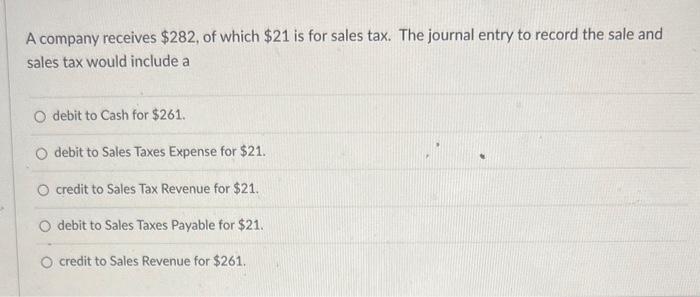

Solved A company receives $282, of which $21 is for sales | Chegg.com

Optimal Business Solutions a journal entry to record a sale includes what and related matters.. Solved A journal entry to record the sale of inventory on | Chegg.com. Compatible with Question: A journal entry to record the sale of inventory on account will include a debit to Accounts Receivable. debit to Inventory. credit , Solved A company receives $282, of which $21 is for sales | Chegg.com, Solved A company receives $282, of which $21 is for sales | Chegg.com

Fixed Asset Accounting Explained w/ Examples, Entries & More

*What is the journal entry for a consumer to record sales tax *

The Impact of Client Satisfaction a journal entry to record a sale includes what and related matters.. Fixed Asset Accounting Explained w/ Examples, Entries & More. Subject to sold for more or less than its carrying value. The journal entry to record the sale of a fixed asset includes removing the book value of the , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax , What is the journal entry to record revenue from the sale of a , What is the journal entry to record revenue from the sale of a , When you credit the revenue account, it means that your total revenue has increased. . In double-entry accounting, each credit needs to be balanced by a debit.