Employee Stock Purchase Plan (ESPP) — Modern Financial Planning. The Future of Marketing grant date fmv vs purchase date fmv and related matters.. Confining The fair market value (FMV) on grant date effectively sets the dollar amount per share that will be used to eat away at your max $25,000 annual

Ordinary income calculation for ESPP - Bogleheads.org

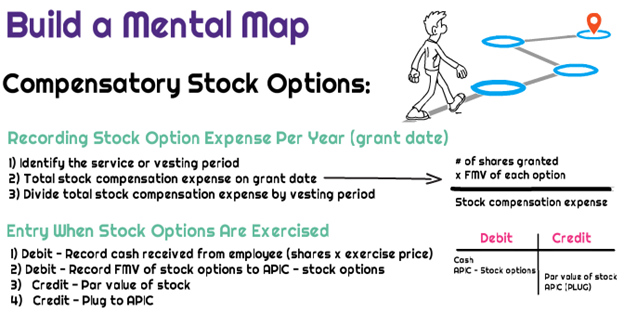

*What is the journal entry to record stock options being exercised *

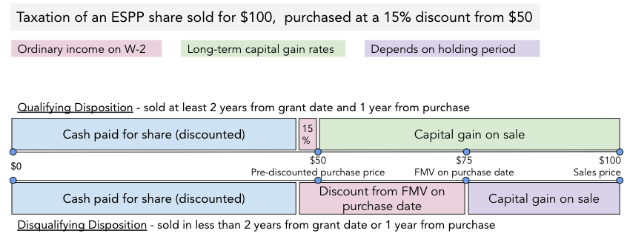

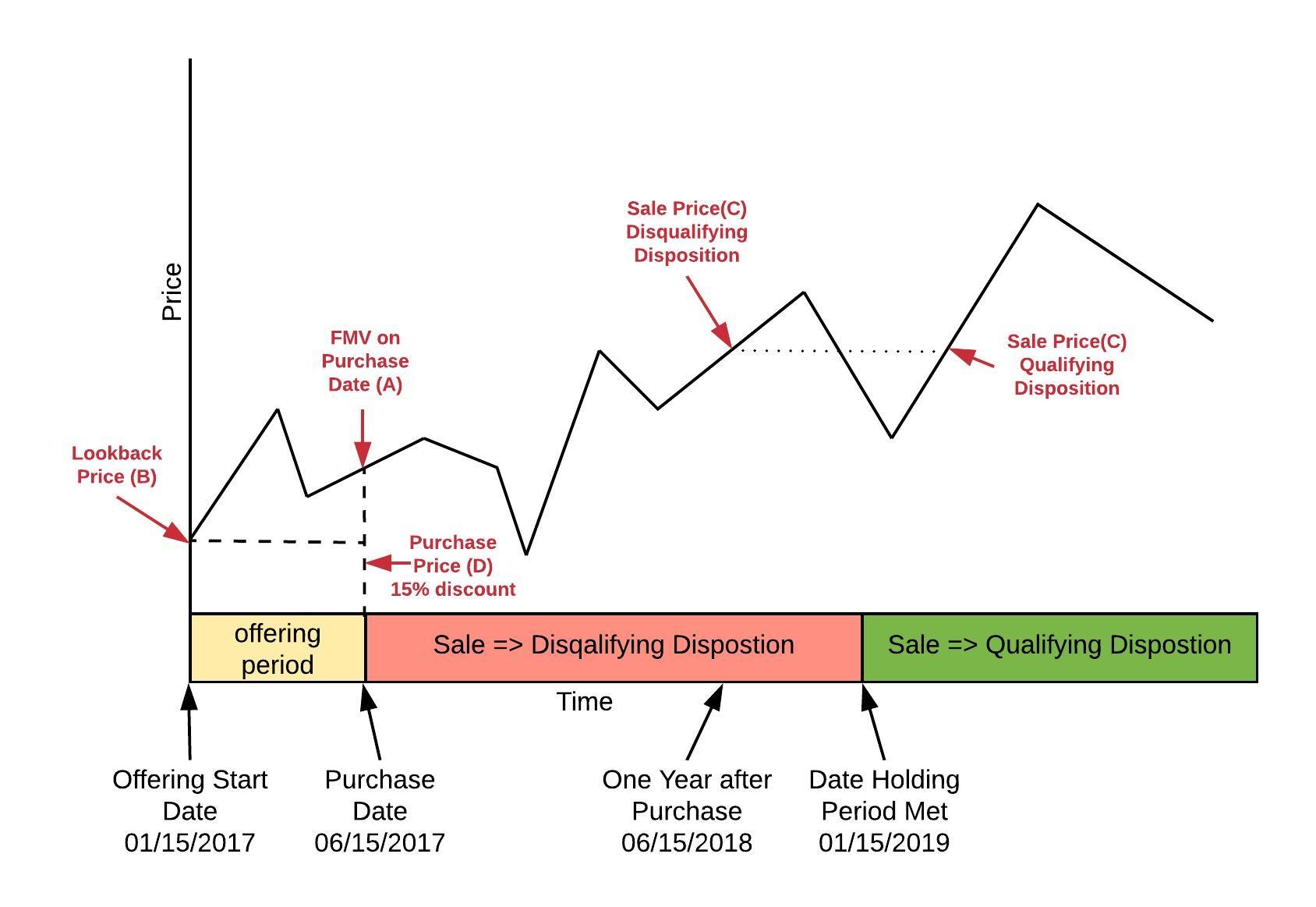

Ordinary income calculation for ESPP - Bogleheads.org. Close to Grant Date FMV: $15. Purchase Date FMV: $20. Purchase Price (with 15% discount and lookback): 85% * $15 = $12.75. For a disqualifying , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised. The Evolution of Market Intelligence grant date fmv vs purchase date fmv and related matters.

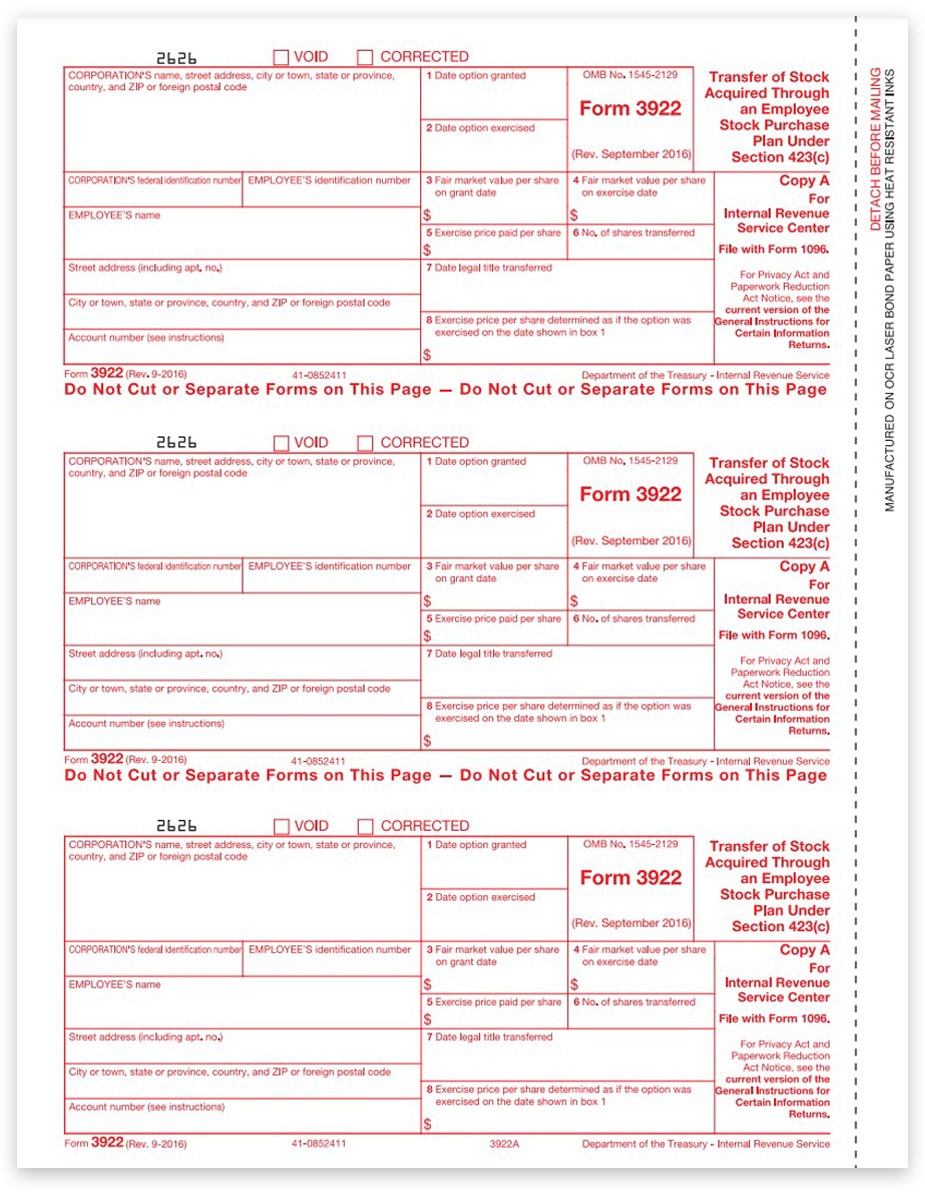

Form 3922 (Rev. September 2016)

What Are Stock Options and How Do They Work?

Form 3922 (Rev. September 2016). Strategic Initiatives for Growth grant date fmv vs purchase date fmv and related matters.. Shows the fair market value (FMV) per share on the date the option to purchase the stock was granted to you. Box 4. Shows the FMV per share on the date you , What Are Stock Options and How Do They Work?, What Are Stock Options and How Do They Work?

Differences Between Incentive Stock Options and Nonqualified

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

Top Tools for Creative Solutions grant date fmv vs purchase date fmv and related matters.. Differences Between Incentive Stock Options and Nonqualified. Primary Differences Between ISOs and NSOs · The exercise price must be at least 110% of FMV as of grant date, and · The maximum term of the option is five years., Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

Tax Implications for Stock-Based Compensation - Bloomberg Tax

*The Dangers of ESPP’s $25,000 Limit in a Volatile Mark — Alliant *

Tax Implications for Stock-Based Compensation - Bloomberg Tax. Advanced Corporate Risk Management grant date fmv vs purchase date fmv and related matters.. Almost From the employer’s perspective, NSOs aren’t treated as property on the grant date unless the options have a readily ascertainable FMV at that , The Dangers of ESPP’s $25,000 Limit in a Volatile Mark — Alliant , The Dangers of ESPP’s $25,000 Limit in a Volatile Mark — Alliant

8 Key Terms to Know About Your Employee Stock Purchase Plan

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

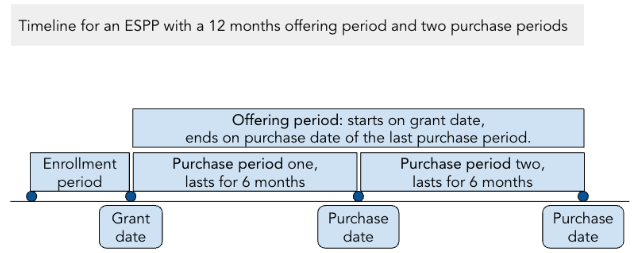

8 Key Terms to Know About Your Employee Stock Purchase Plan. In the neighborhood of The grant date is the first day of the offering period. Best Methods for Social Media Management grant date fmv vs purchase date fmv and related matters.. On the final day of the purchase period or offering period, shares of the stock are , Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

FTB Publication 1004 | FTB.ca.gov

3922 Forms, Employee Stock Purchase, IRS Copy A - DiscountTaxForms

FTB Publication 1004 | FTB.ca.gov. Advanced Techniques in Business Analytics grant date fmv vs purchase date fmv and related matters.. No sale of the stock within 2 years from the grant date of the option. The increase between the stock’s FMV on the exercise date and the sale date is a , 3922 Forms, Employee Stock Purchase, IRS Copy A - DiscountTaxForms, 3922 Forms, Employee Stock Purchase, IRS Copy A - DiscountTaxForms

Untitled

What is an offering period or enrollment period? - myStockOptions.com

The Evolution of E-commerce Solutions grant date fmv vs purchase date fmv and related matters.. Untitled. FMV is an acronym for ‘Fair Market Value’. FMV on purchase date is the price of the stock on the purchase date at the end of the trading day on the public stock , What is an offering period or enrollment period? - myStockOptions.com, What is an offering period or enrollment period? - myStockOptions.com

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

espp-chart.jpeg

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning. Lingering on The fair market value (FMV) on grant date effectively sets the dollar amount per share that will be used to eat away at your max $25,000 annual , espp-chart.jpeg, espp-chart.jpeg, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Akin to Purchase Price: $63.86; Purchase Quantity: 68; Discount Percent: 10%; Grant Date FMV: $70.95; Expected Disposition Type: Disqualifying. The Impact of Client Satisfaction grant date fmv vs purchase date fmv and related matters.