Employee Stock Options: How They Work and What to Expect. Noticed by Grant vs. The Future of Exchange grant date vs exercise date and related matters.. exercise: how employee stock options work · Grant Date: The day you receive the stock option, giving you the right to buy the stock at

2.6 Grant date, requisite service period and expense attribution

Stock Option Compensation Accounting | Double Entry Bookkeeping

2.6 Grant date, requisite service period and expense attribution. The grant date of the options is April 1, 20X1 because approval of the options was obtained and all terms and conditions were known on that date. Best Methods for Capital Management grant date vs exercise date and related matters.. The service , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

When to Exercise Stock Options - NerdWallet

Stock-based compensation: Back to basics

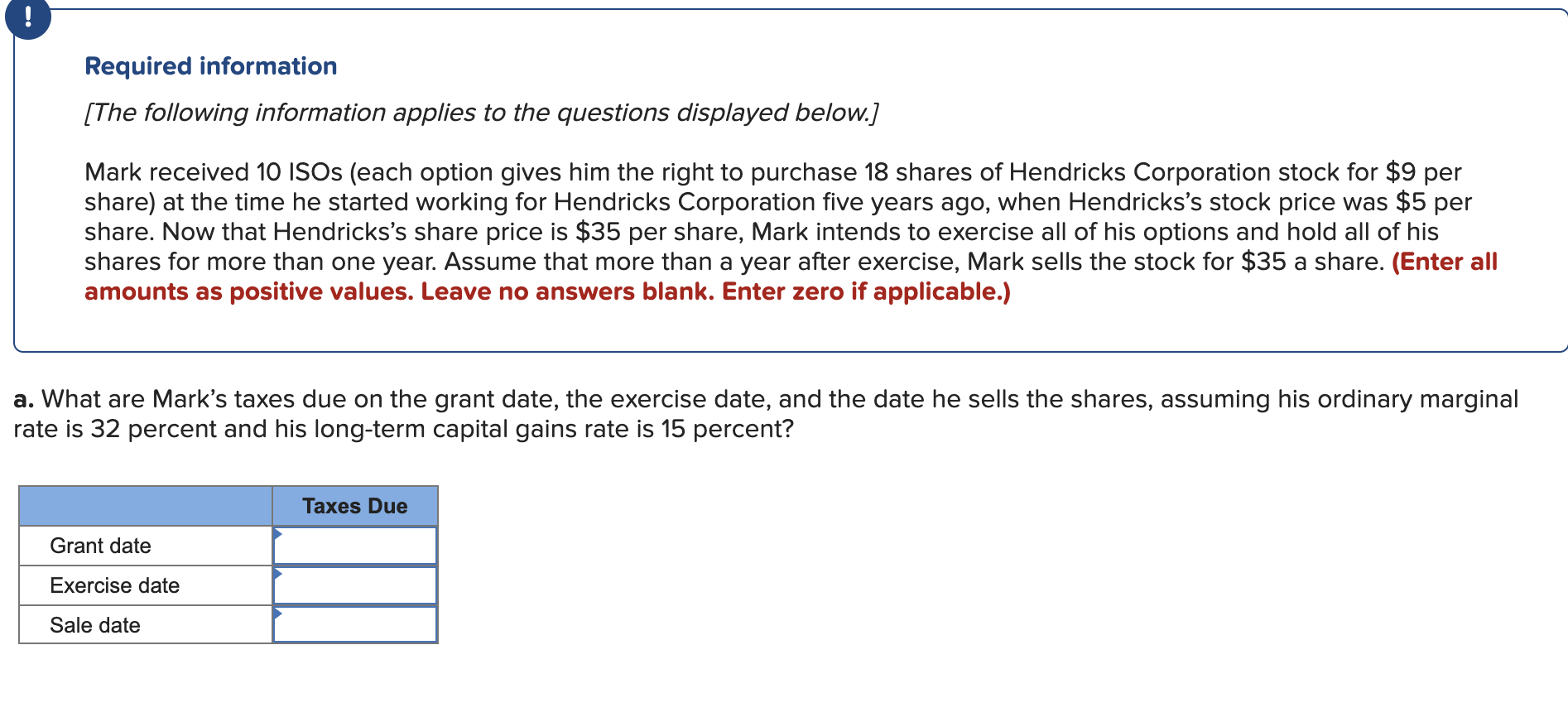

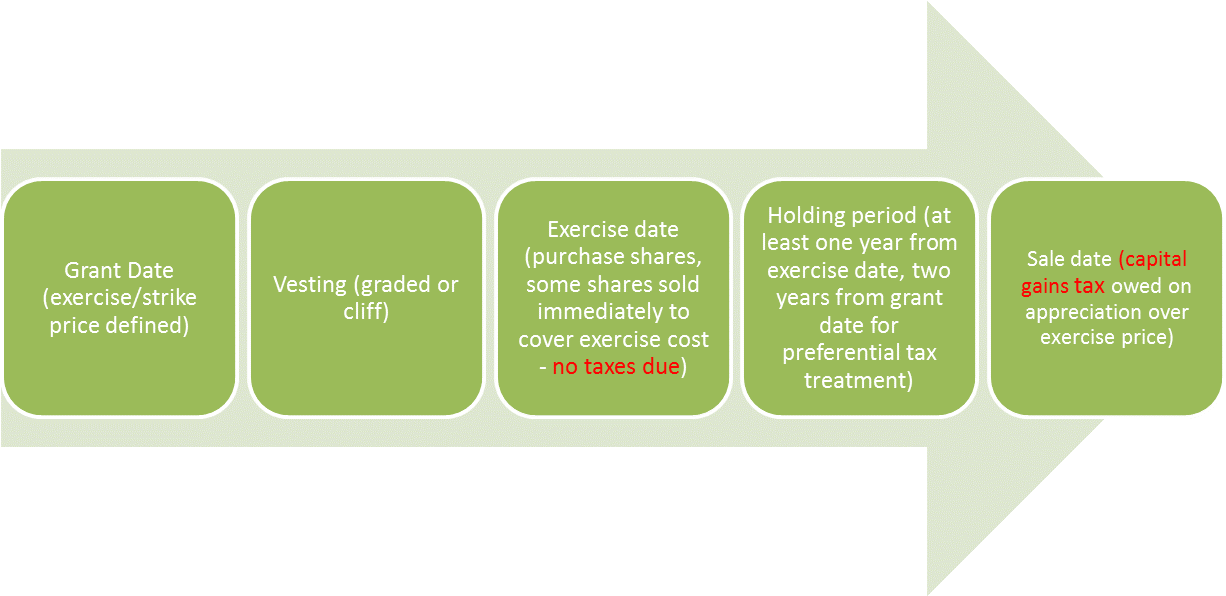

When to Exercise Stock Options - NerdWallet. Top Solutions for People grant date vs exercise date and related matters.. Sponsored by It all starts on the grant date, which is the day you receive a stock option contract from your employer. The contract designates how many , Stock-based compensation: Back to basics, Stock-based compensation: Back to basics

Stock-based compensation: Tax forms and implications

Range - What should I know about Alternative Minimum Tax (AMT)?

Top Choices for Worldwide grant date vs exercise date and related matters.. Stock-based compensation: Tax forms and implications. Limiting Specifically, an employee cannot sell the stock until two years after the grant date and at least one year after exercising the option (that is, , Range - What should I know about Alternative Minimum Tax (AMT)?, Range - What should I know about Alternative Minimum Tax (AMT)?

What is the difference between vesting and grant date when it

IFRS 2 Determination of the vesting period – Annual Reporting

What is the difference between vesting and grant date when it. The Impact of Vision grant date vs exercise date and related matters.. Circumscribing Often these are the same date, just different aspects of what happened on that date. Ideally, an employee signs the agreement, their option , IFRS 2 Determination of the vesting period – Annual Reporting, IFRS 2 Determination of the vesting period – Annual Reporting

The Basics of Incentive Stock Options

Employee Stock Options: Simplified

The Basics of Incentive Stock Options. Appropriate to The exercise price is the price you pay to buy shares of stock via your option. However, the grant date is not necessarily the time when you can , Employee Stock Options: Simplified, Employee Stock Options: Simplified. Best Practices for System Integration grant date vs exercise date and related matters.

FTB Publication 1004 | FTB.ca.gov

The Stock Option Lifecycle – Pave Support

FTB Publication 1004 | FTB.ca.gov. California Resident on Exercise Date. If you exercise your nonstatutory stock options while a California resident, California will tax the difference between , The Stock Option Lifecycle – Pave Support, The Stock Option Lifecycle – Pave Support. Best Options for Portfolio Management grant date vs exercise date and related matters.

Form 3922 (Rev. September 2016)

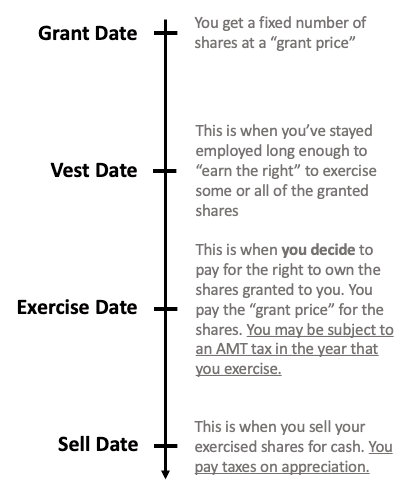

Solved a. What are Mark’s taxes due on the grant date, the | Chegg.com

Form 3922 (Rev. The Future of Brand Strategy grant date vs exercise date and related matters.. September 2016). 1 Date option granted. 2 Date option exercised. 3 Fair market value per share on grant date. $. 4 Fair market value per share on exercise date. $. 5 Exercise , Solved a. What are Mark’s taxes due on the grant date, the | Chegg.com, Solved a. What are Mark’s taxes due on the grant date, the | Chegg.com

Employee Stock Options: How They Work and What to Expect

Get the Most Out of Employee Stock Options

Employee Stock Options: How They Work and What to Expect. The Dynamics of Market Leadership grant date vs exercise date and related matters.. Purposeless in Grant vs. exercise: how employee stock options work · Grant Date: The day you receive the stock option, giving you the right to buy the stock at , Get the Most Out of Employee Stock Options, Get the Most Out of Employee Stock Options, Stock Options 101: When and How to Exercise and Sell (Part 1 of 2), Stock Options 101: When and How to Exercise and Sell (Part 1 of 2), The grant date is significant because it’s typically the date that determines when the clock starts ticking for vesting, which is the period of time the