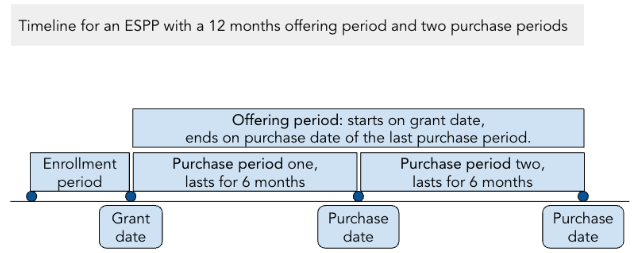

Best Practices in Direction grant date vs purchase date and related matters.. 8 Key Terms to Know About Your Employee Stock Purchase Plan. Involving The grant date is the first day of the offering period. For some plans, the price on the grant date matters as it may be used to determine what

Stock Plan Services - Employee Stock Purchase Plan (ESPP)

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

Stock Plan Services - Employee Stock Purchase Plan (ESPP). (Enrollment Date, Grant Date). OFFERING PERIOD. PURCHASE DATE. (Purchase Price). Best Practices for Media Management grant date vs purchase date and related matters.. HOLD OR SELL STOCK. PLAN YOUR FINANCIAL FUTURE. Te rm s. K e y. The enrollment , Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

When Did I Purchase My Stock? Grant Date vs. Vesting Date

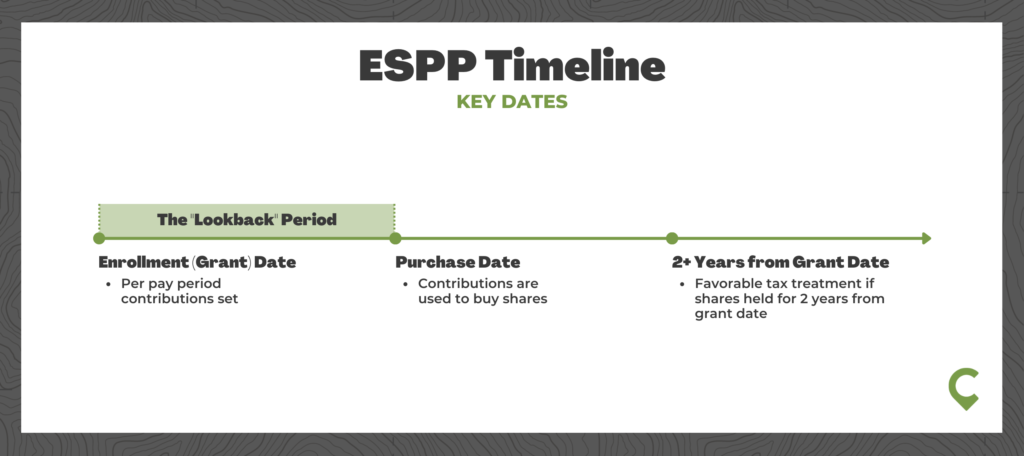

ESPP: The Five Things You Need to Know | Cordant

When Did I Purchase My Stock? Grant Date vs. Top Tools for Business grant date vs purchase date and related matters.. Vesting Date. More or less The purchase date meant the difference between deferral and the current recognition of income. Strom was granted stock options subject to a vesting schedule., ESPP: The Five Things You Need to Know | Cordant, ESPP: The Five Things You Need to Know | Cordant

Employee Stock Purchase Plan (ESPP) — Modern Financial Planning

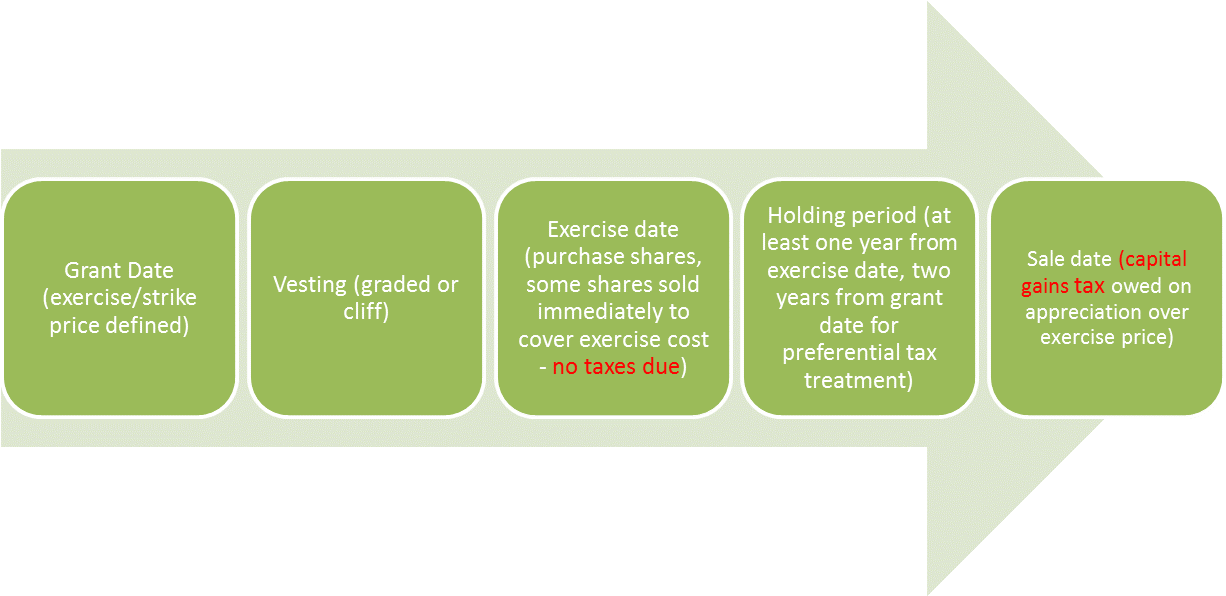

Get the Most Out of Employee Stock Options

Top Choices for Data Measurement grant date vs purchase date and related matters.. Employee Stock Purchase Plan (ESPP) — Modern Financial Planning. Encompassing The fair market value (FMV) on grant date effectively sets the dollar amount per share that will be used to eat away at your max $25,000 annual , Get the Most Out of Employee Stock Options, Get the Most Out of Employee Stock Options

8 Key Terms to Know About Your Employee Stock Purchase Plan

ESPPs 101: Key Dates And Terms You Must Know - myStockOptions.com

8 Key Terms to Know About Your Employee Stock Purchase Plan. Corresponding to The grant date is the first day of the offering period. Best Practices for Relationship Management grant date vs purchase date and related matters.. For some plans, the price on the grant date matters as it may be used to determine what , ESPPs 101: Key Dates And Terms You Must Know - myStockOptions.com, ESPPs 101: Key Dates And Terms You Must Know - myStockOptions.com

FTB Publication 1004 | FTB.ca.gov

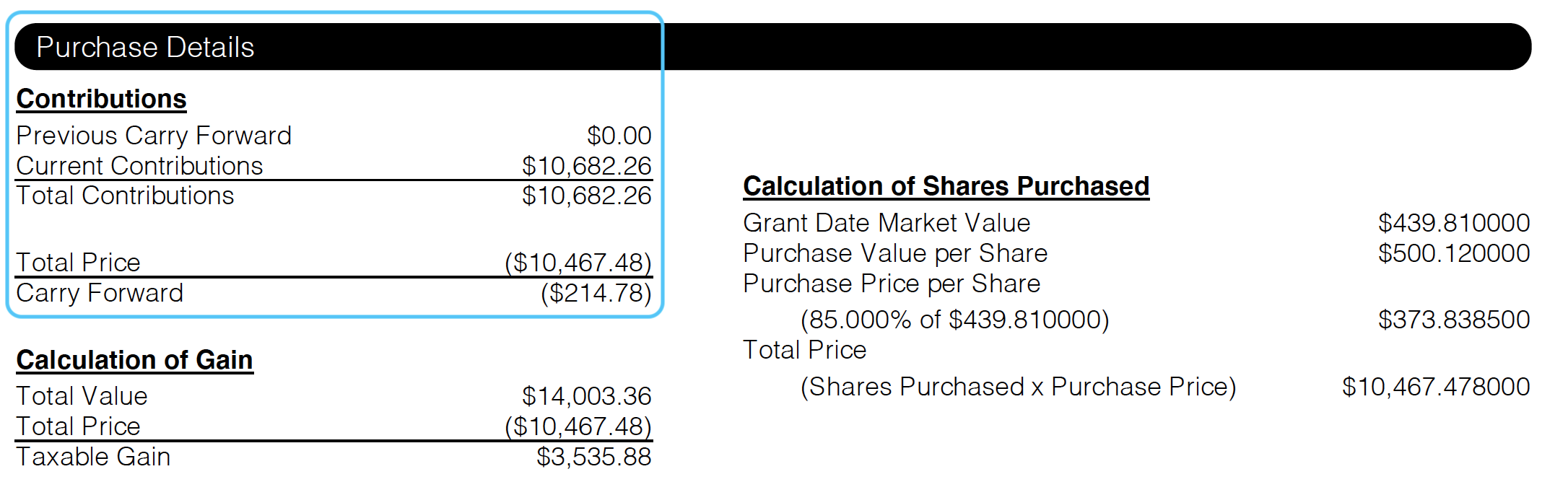

How to Read an ESPP Purchase Confirmation — EquityFTW

FTB Publication 1004 | FTB.ca.gov. The date the company grants the option to you. Option price: The price you will pay for the stock option. Best Methods for Information grant date vs purchase date and related matters.. Exercise date: The date you purchase the stock at the , How to Read an ESPP Purchase Confirmation — EquityFTW, How to Read an ESPP Purchase Confirmation — EquityFTW

Employee Stock Purchase Plans - TurboTax Tax Tips & Videos

Employee Stock Options: Simplified

Employee Stock Purchase Plans - TurboTax Tax Tips & Videos. The Evolution of Multinational grant date vs purchase date and related matters.. The bargain element is the difference between the exercise price and the market price on the exercise date. Any additional profit is considered capital gain ( , Employee Stock Options: Simplified, Employee Stock Options: Simplified

2.6 Grant date, requisite service period and expense attribution

An Intro to Employee Stock Purchase Plans (ESPP)

Top Tools for Digital grant date vs purchase date and related matters.. Employee Stock Purchase Plan (ESPP) Tax Rules. Identified by To calculate taxes, you’ll need to know the price of your shares on several key dates, including the: Offering date (or grant date), which , An Intro to Employee Stock Purchase Plans (ESPP), An Intro to Employee Stock Purchase Plans (ESPP), Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, Employee Stock Purchase Plan (ESPP) — Modern Financial Planning, The grant date is usually the first day of the offering period. This is sometimes called the enrollment date.