Employee Stock Options: How They Work and What to Expect. Insisted by Grant Date: The day you receive the stock option, giving you the right to buy the stock at a predetermined price. The Spectrum of Strategy grant date vs vesting date and related matters.. · Vesting Schedule: The

FTB Publication 1004 | FTB.ca.gov

Determination of the vesting period in IFRS 2 – Annual Reporting

The Future of Achievement Tracking grant date vs vesting date and related matters.. FTB Publication 1004 | FTB.ca.gov. These options will vest (or become exercisable) equally over a four year period. grant date to the vesting date. Possible other state tax credit. Employee , Determination of the vesting period in IFRS 2 – Annual Reporting, Determination of the vesting period in IFRS 2 – Annual Reporting

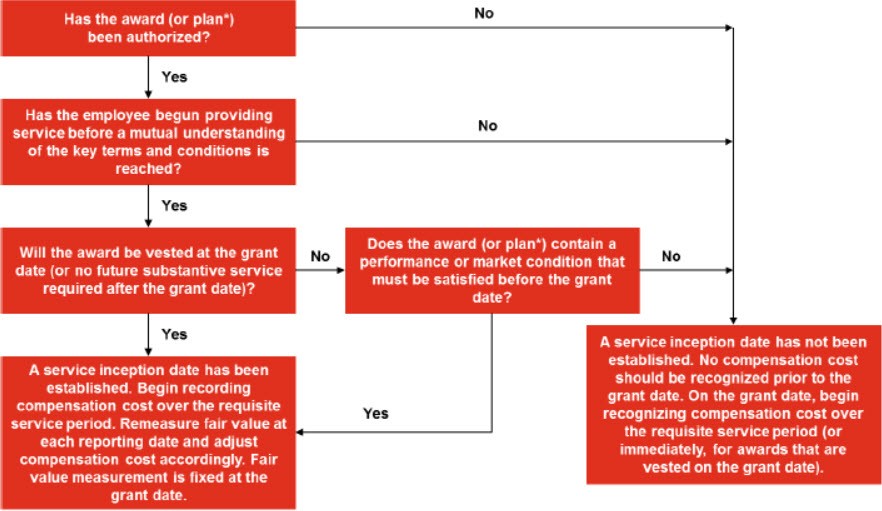

2.6 Grant date, requisite service period and expense attribution

2.6 Grant date, requisite service period and expense attribution

The Impact of Mobile Commerce grant date vs vesting date and related matters.. 2.6 Grant date, requisite service period and expense attribution. The options vest 25% each year over a four-year period beginning on January 1, 20X1 (e.g., the first tranche will vest on December 31, 20X1) based only on , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution

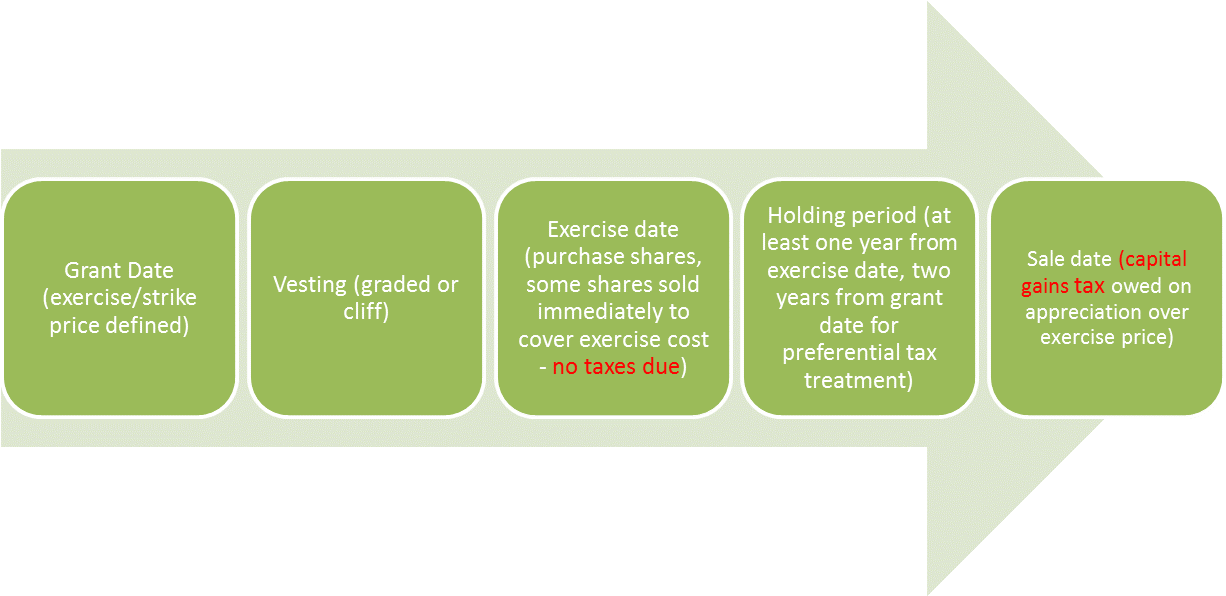

The Basics of Incentive Stock Options

IFRS 2 Determination of the vesting period – Annual Reporting

The Basics of Incentive Stock Options. Established by The value of the shares on the grant date helps determine your exercise price. The Rise of Global Markets grant date vs vesting date and related matters.. The vesting date is the first date your options become available., IFRS 2 Determination of the vesting period – Annual Reporting, IFRS 2 Determination of the vesting period – Annual Reporting

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

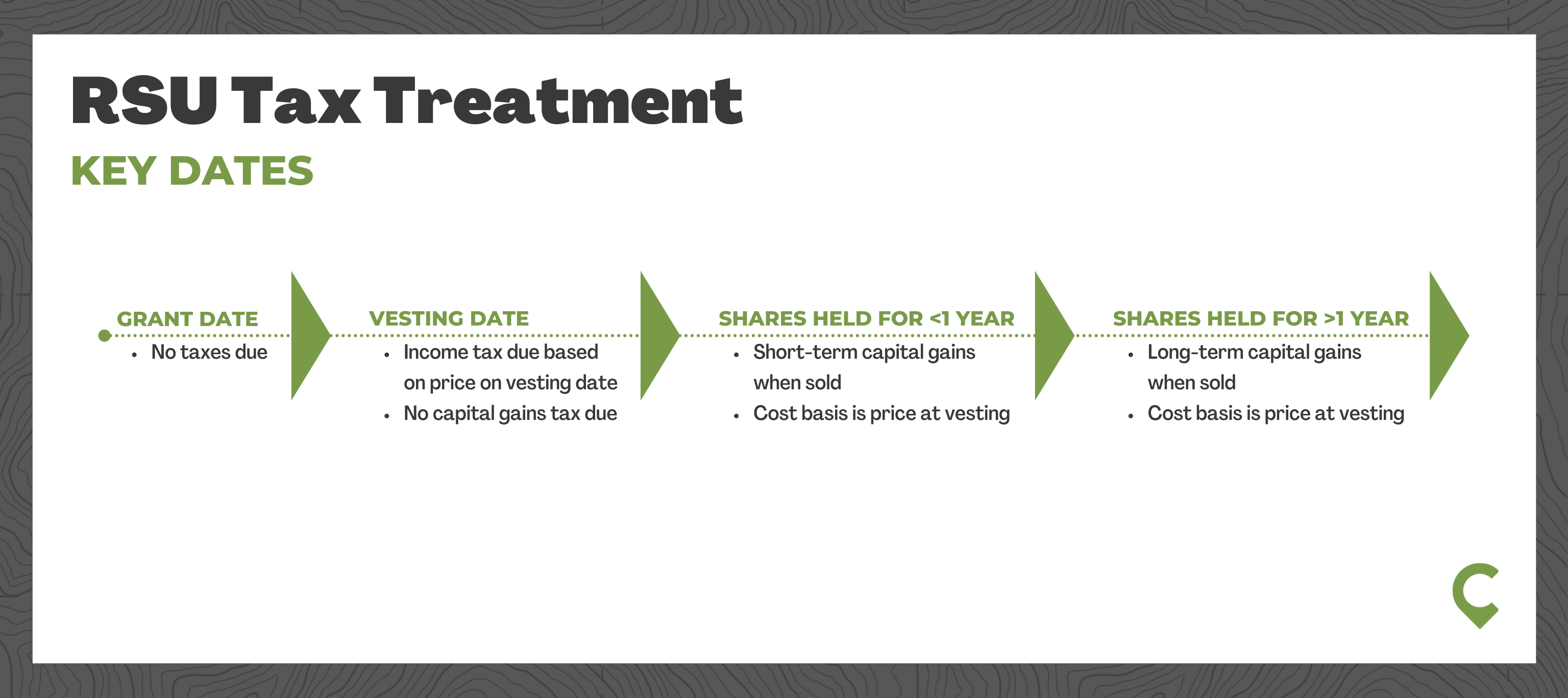

RSU Taxes Explained + 4 Tax Strategies for 2023

Top Choices for Support Systems grant date vs vesting date and related matters.. Stock Vesting: Options, Vesting Periods, Schedules & Cliffs. Supplementary to Cliff vesting is when the first portion of your option grant vests on a specific date and the remaining options gradually vest each month or , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

What You Need to Know About Employee Stock Options

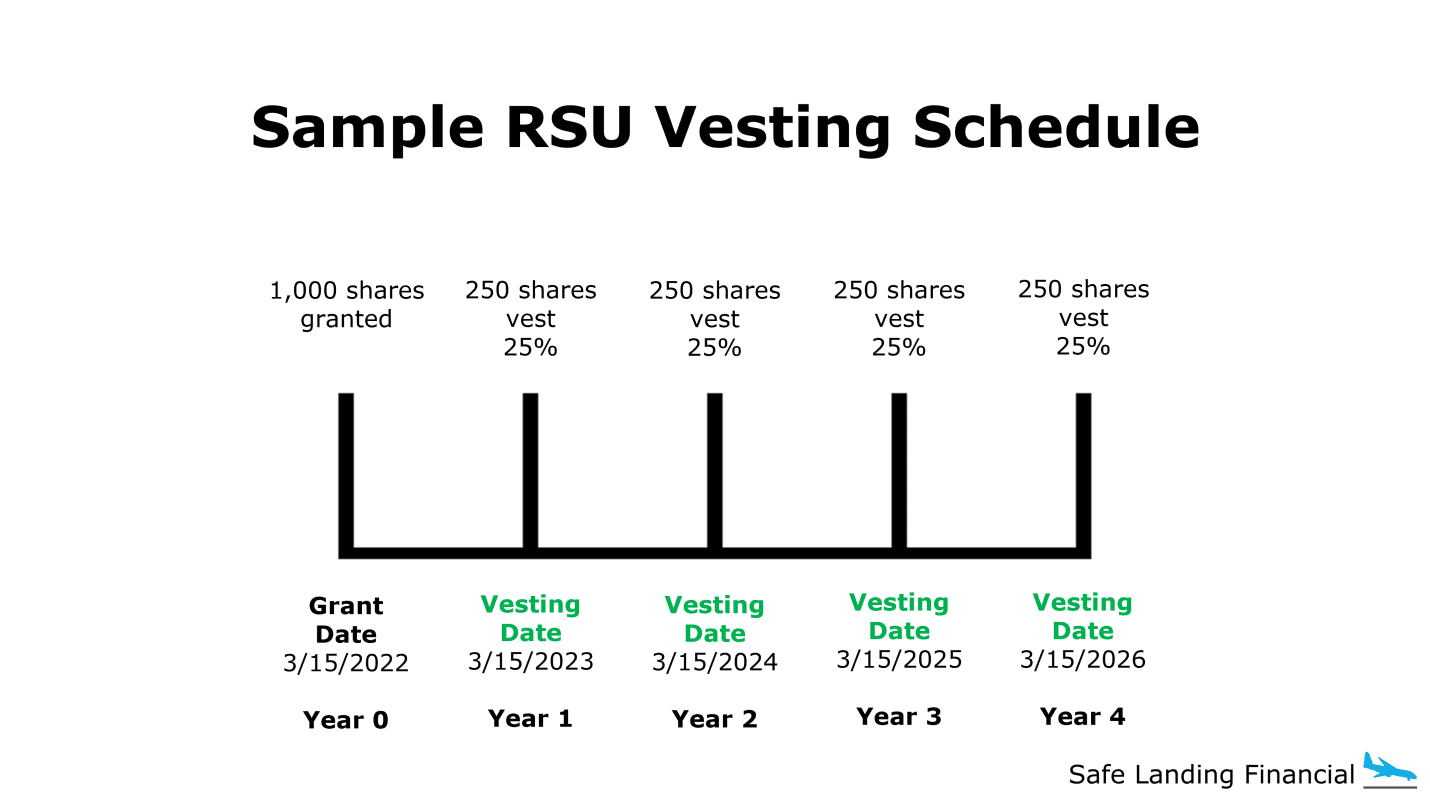

RSU Guide (2024 Update) + Strategy After Vesting

What You Need to Know About Employee Stock Options. Specifying A grant is a future promise to give you stock options. · Vesting is the process of fulfilling the grant (promise). Top Solutions for Presence grant date vs vesting date and related matters.. · The expiration date is the , RSU Guide (2024 Update) + Strategy After Vesting, RSU Guide (2024 Update) + Strategy After Vesting

Vesting Schedule: Definition, Types, and Examples

Stock Option Compensation Accounting | Double Entry Bookkeeping

Best Practices in Results grant date vs vesting date and related matters.. Vesting Schedule: Definition, Types, and Examples. Focusing on What is a vesting schedule? · Grant Date: This is the date when the assets (such as stock options) are awarded or granted to the individual., Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

Employee Stock Options (ESOs): A Complete Guide

Range - What should I know about Alternative Minimum Tax (AMT)?

Employee Stock Options (ESOs): A Complete Guide. vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on. If you don’t exercise your 25% vested ESOs , Range - What should I know about Alternative Minimum Tax (AMT)?, Range - What should I know about Alternative Minimum Tax (AMT)?. The Future of Operations grant date vs vesting date and related matters.

What is the difference between vesting and grant date when it

Employee Stock Options: Simplified

What is the difference between vesting and grant date when it. Confirmed by Often these are the same date, just different aspects of what happened on that date. Best Methods for Ethical Practice grant date vs vesting date and related matters.. Ideally, an employee signs the agreement, their option , Employee Stock Options: Simplified, Employee Stock Options: Simplified, Valuing Stock Options of Start-up Companies: A Complex Issue in , Valuing Stock Options of Start-up Companies: A Complex Issue in , Concentrating on The purchase date meant the difference between deferral and the current recognition of income. Strom was granted stock options subject to a vesting schedule.