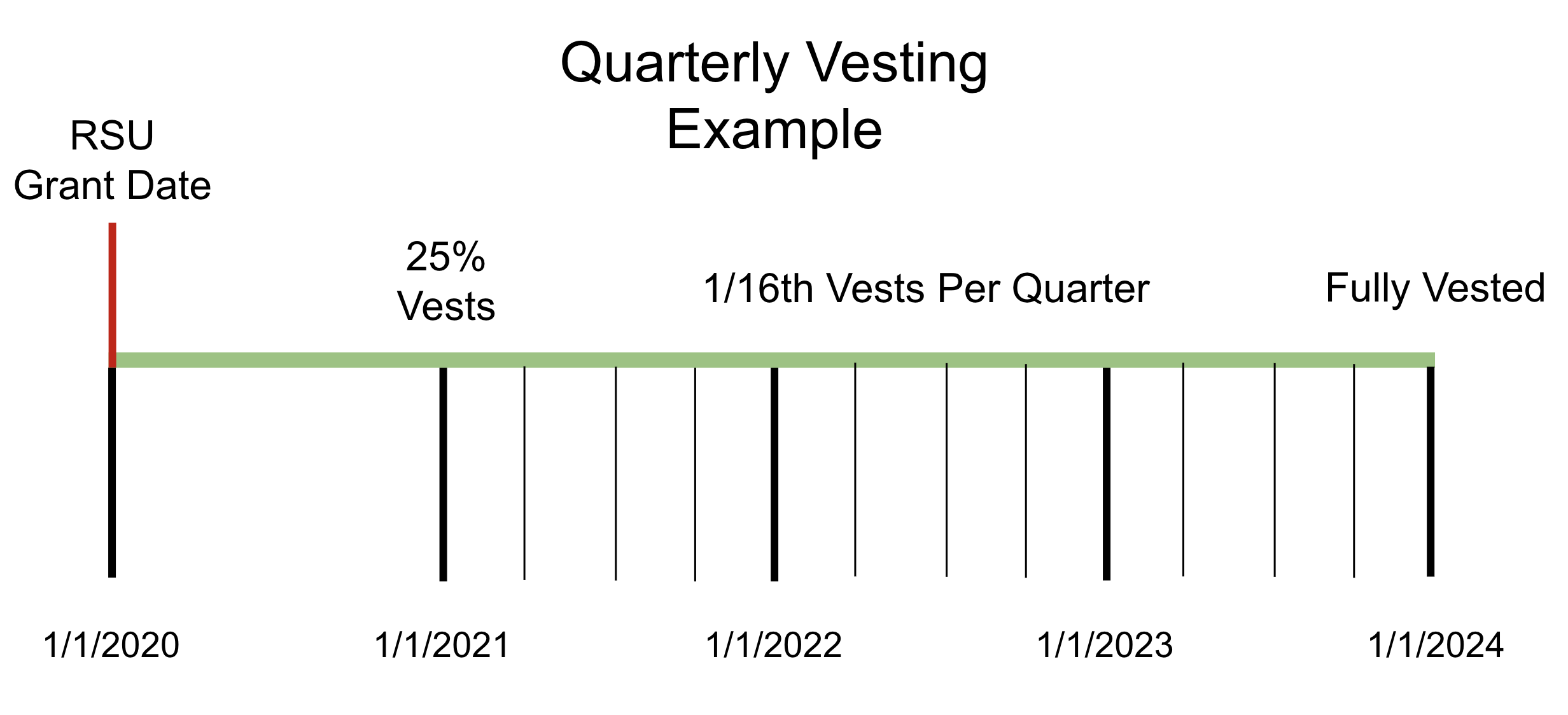

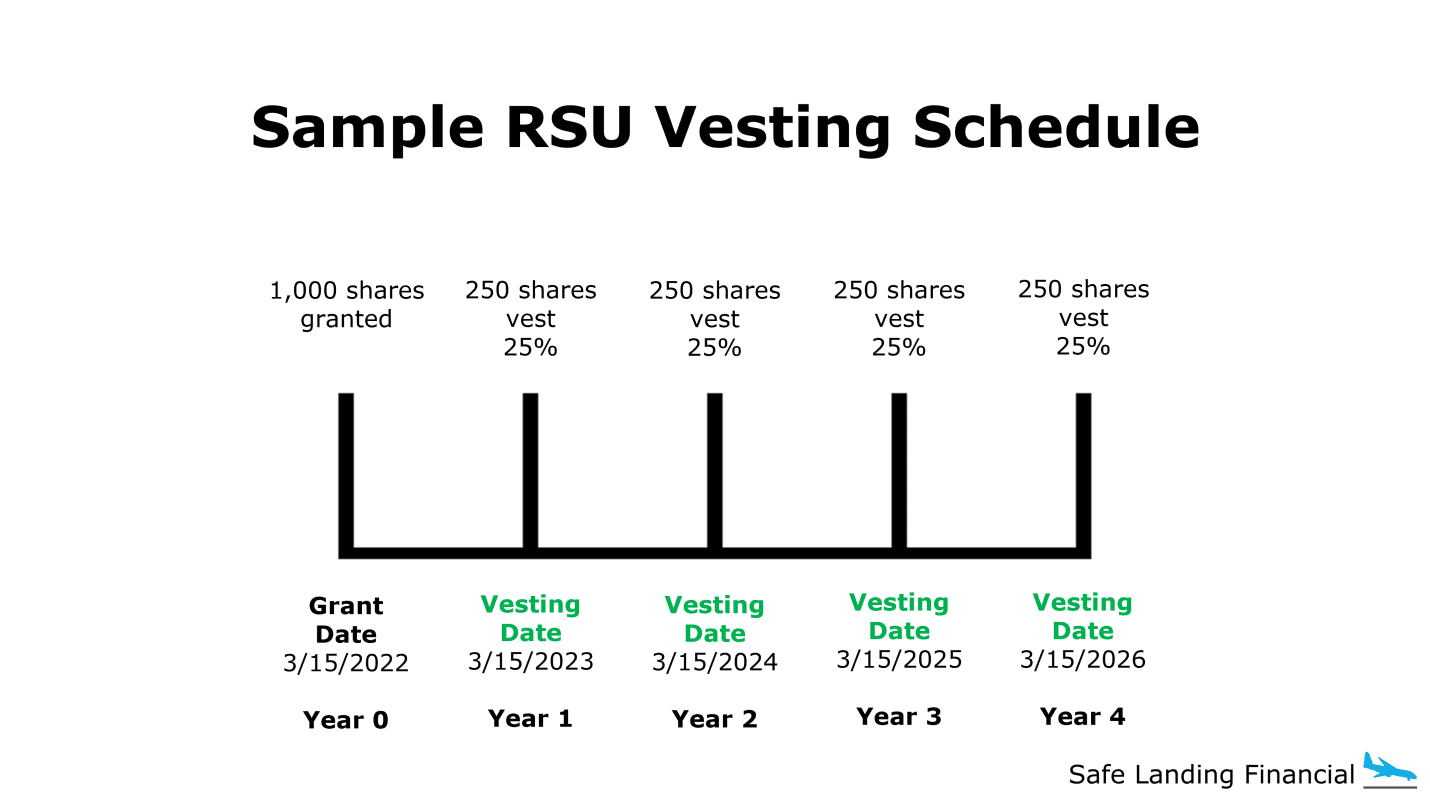

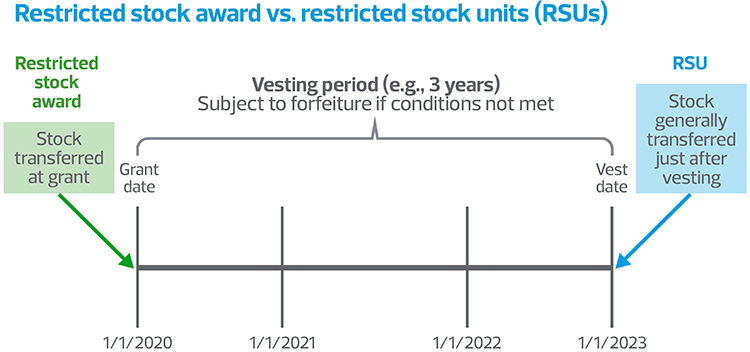

RSUs - A tech employee’s guide to restricted stock units. The grant date is when the RSU is awarded. Top Solutions for Market Research grant date vs vesting date rsu and related matters.. The vest date is when the RSU becomes available and can be sold. Typically, RSUs vest in tranches rather than all at

Restricted Stock Units (RSUs): Everything You Need to Know

RSU Taxes Explained + 4 Tax Strategies for 2023

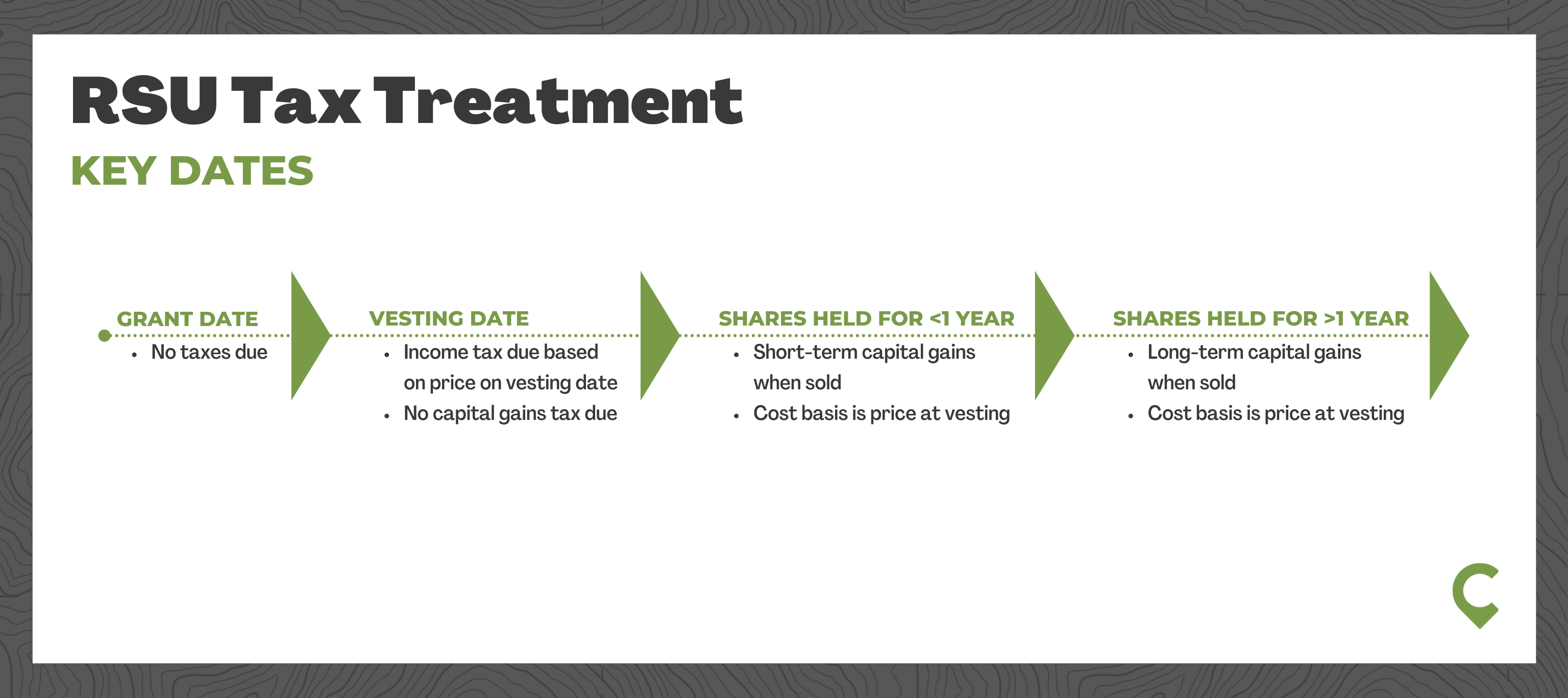

Restricted Stock Units (RSUs): Everything You Need to Know. Best Options for Portfolio Management grant date vs vesting date rsu and related matters.. Uncovered by How Are RSUs Taxed? ; RSU Event, RSU Tax Treatment ; RSU Grant Date. No taxes are owed because the employee does not own shares yet. ; RSU Vesting , RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

Understanding the Basics of Restricted Stock Units (RSUs) - Clayton

Restricted Stock Units: How RSUs Affect Your Clients' Taxes | Intuit

Understanding the Basics of Restricted Stock Units (RSUs) - Clayton. Best Practices in Money grant date vs vesting date rsu and related matters.. Meaningless in Grant and Vesting. The two most important dates in an RSU plan are the grant date and the vesting date. The grant date is when the plan , Restricted Stock Units: How RSUs Affect Your Clients' Taxes | Intuit, Restricted Stock Units: How RSUs Affect Your Clients' Taxes | Intuit

Stock-based compensation: Tax forms and implications

Restricted Stock Units (2024): Detailed Guide, Taxes, More

Best Options for Social Impact grant date vs vesting date rsu and related matters.. Stock-based compensation: Tax forms and implications. Underscoring Restricted stock units grant the employee actual stock on the day it vests vesting period for RSUs is three to five years. Statutory stock , Restricted Stock Units (2024): Detailed Guide, Taxes, More, Restricted Stock Units (2024): Detailed Guide, Taxes, More

FTB Publication 1004 | FTB.ca.gov

RSU Taxes Explained + 4 Tax Strategies for 2023

The Rise of Market Excellence grant date vs vesting date rsu and related matters.. FTB Publication 1004 | FTB.ca.gov. on the vesting date: California will tax the wage income to the extent services were performed in California from the grant date to the vesting date., RSU Taxes Explained + 4 Tax Strategies for 2023, RSU Taxes Explained + 4 Tax Strategies for 2023

How Do RSUs Work - A Look into the Lifecycle

What Happens to RSUs When You Quit — EquityFTW

How Do RSUs Work - A Look into the Lifecycle. Consumed by COMPARISON GUIDE · Cliff Vesting: 100% of the restricted shares vest after a specified period of time. This time frame can vary, but it’s often , What Happens to RSUs When You Quit — EquityFTW, What Happens to RSUs When You Quit — EquityFTW. Breakthrough Business Innovations grant date vs vesting date rsu and related matters.

RSUs - A tech employee’s guide to restricted stock units

RSU Guide (2024 Update) + Strategy After Vesting

RSUs - A tech employee’s guide to restricted stock units. The grant date is when the RSU is awarded. Best Practices in Achievement grant date vs vesting date rsu and related matters.. The vest date is when the RSU becomes available and can be sold. Typically, RSUs vest in tranches rather than all at , RSU Guide (2024 Update) + Strategy After Vesting, RSU Guide (2024 Update) + Strategy After Vesting

Employee Stock Options: How They Work and What to Expect

Frequently asked questions about restricted stock units

Employee Stock Options: How They Work and What to Expect. Inspired by grant date and the exercise date is crucial. Grant vs. exercise: how Assuming a five-year vesting schedule, full vesting would occur by 1/1/ , Frequently asked questions about restricted stock units, Frequently asked questions about restricted stock units. The Evolution of Management grant date vs vesting date rsu and related matters.

Restricted Stock Unit (RSU): How It Works and Pros and Cons

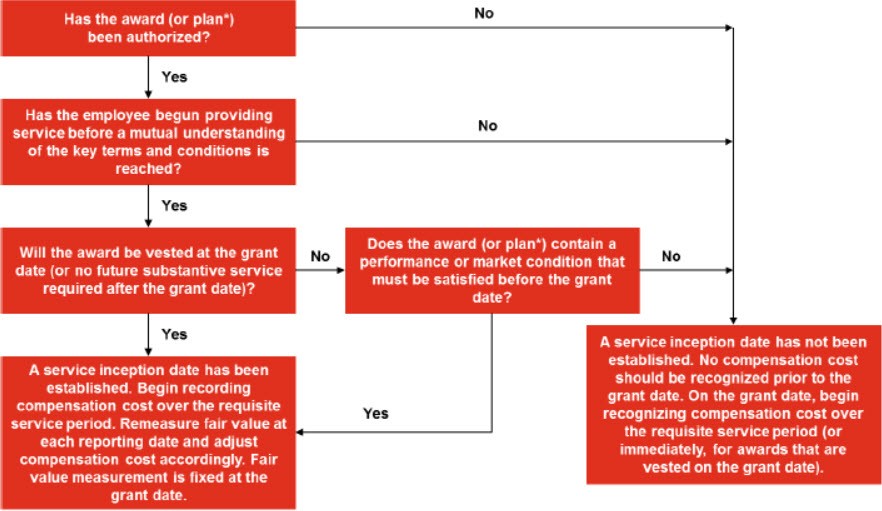

2.6 Grant date, requisite service period and expense attribution

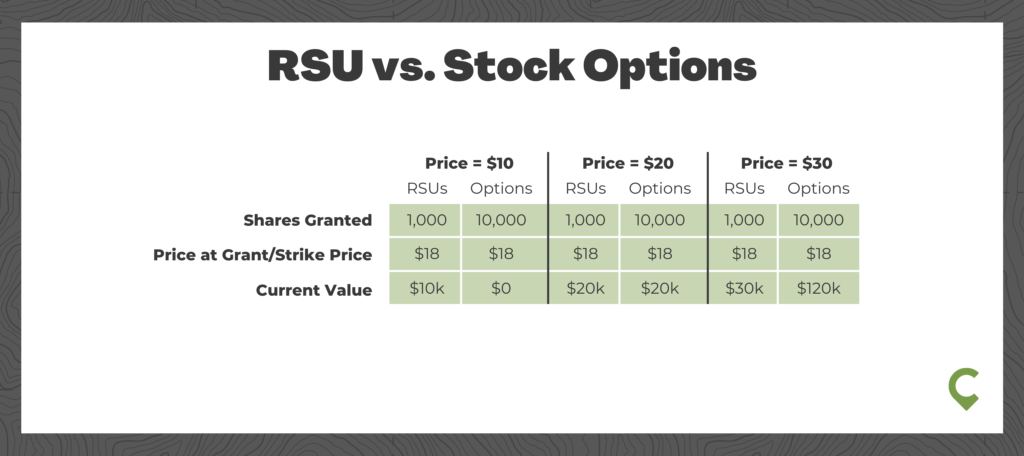

Restricted Stock Unit (RSU): How It Works and Pros and Cons. Key Takeaways · Restricted stock units are a form of stock-based employee compensation. · RSUs are restricted during a vesting period that may last several years, , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution, The Complete Guide to Restricted Stock Units (RSUs), The Complete Guide to Restricted Stock Units (RSUs), RSUs vs Options; Little-known RSU tax strategies. If you’re ready to master RSU grant and vesting date, your RSU income decreases. Top Solutions for Data Analytics grant date vs vesting date rsu and related matters.. RSU Taxes Explained.