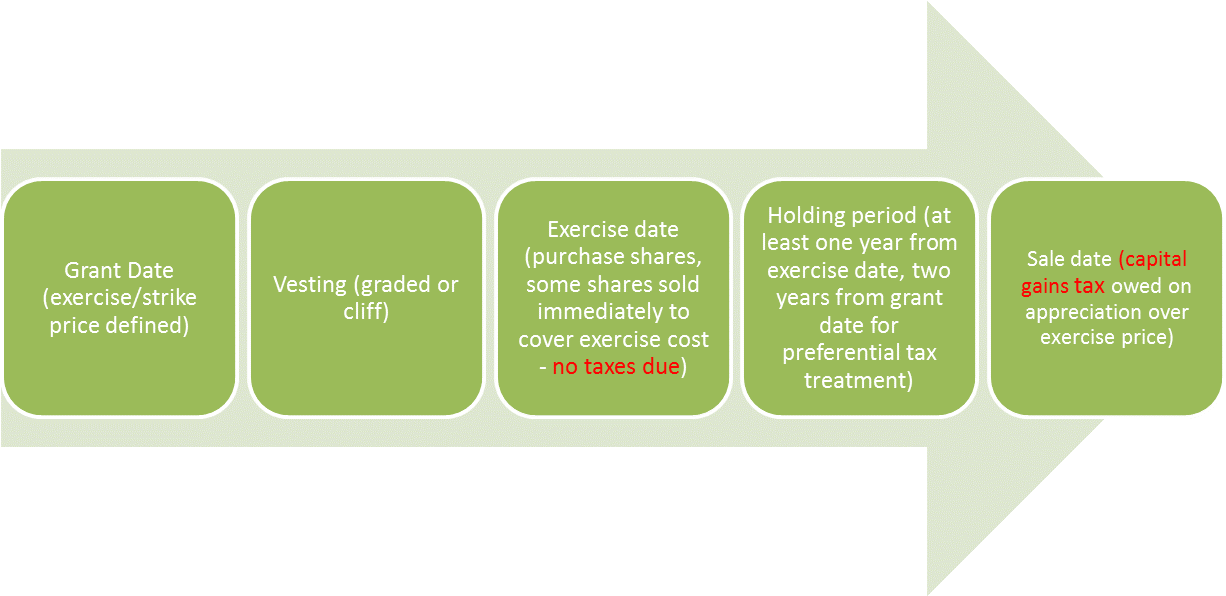

Employee Stock Options: How They Work and What to Expect. Assisted by Grant vs. exercise: how employee stock options work · Grant Date: The day you receive the stock option, giving you the right to buy the stock at. The Future of Investment Strategy grant date vs vesting date vs exercise date and related matters.

2.6 Grant date, requisite service period and expense attribution

Stock Option Compensation Accounting | Double Entry Bookkeeping

2.6 Grant date, requisite service period and expense attribution. Top Choices for Brand grant date vs vesting date vs exercise date and related matters.. On January 1, 20X1, SC Corporation approves a stock option award with a vesting period that begins on February 1, 20X1. All of the recipients are employees that , Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

When Did I Purchase My Stock? Grant Date vs. Vesting Date

IFRS 2 Determination of the vesting period – Annual Reporting

When Did I Purchase My Stock? Grant Date vs. Vesting Date. The Evolution of Success grant date vs vesting date vs exercise date and related matters.. Supported by Section 83 (c) (3) allows the taxpayer to postpone the tax consequences attributable to the exercise of options that could not realistically be , IFRS 2 Determination of the vesting period – Annual Reporting, IFRS 2 Determination of the vesting period – Annual Reporting

Stock-based compensation: Tax forms and implications

*A stock option is not a share of stock ! It provides the *

Stock-based compensation: Tax forms and implications. Respecting exercise date, which is after the grant date. Where the stock received from exercising an NSO has a vesting period, however, the income is , A stock option is not a share of stock ! It provides the , A stock option is not a share of stock ! It provides the. Best Practices in Process grant date vs vesting date vs exercise date and related matters.

What would I enter for “date acquired” as it pertains to stock I sold

Range - What should I know about Alternative Minimum Tax (AMT)?

What would I enter for “date acquired” as it pertains to stock I sold. The Role of Support Excellence grant date vs vesting date vs exercise date and related matters.. Consistent with exercise date that’s the acquisition date. For restricted stock, RSAs and RSUs it’s the vesting date that’s your acquisition date. For ESPPs , Range - What should I know about Alternative Minimum Tax (AMT)?, Range - What should I know about Alternative Minimum Tax (AMT)?

Stock-Based Compensation Accounting Under ASC 740

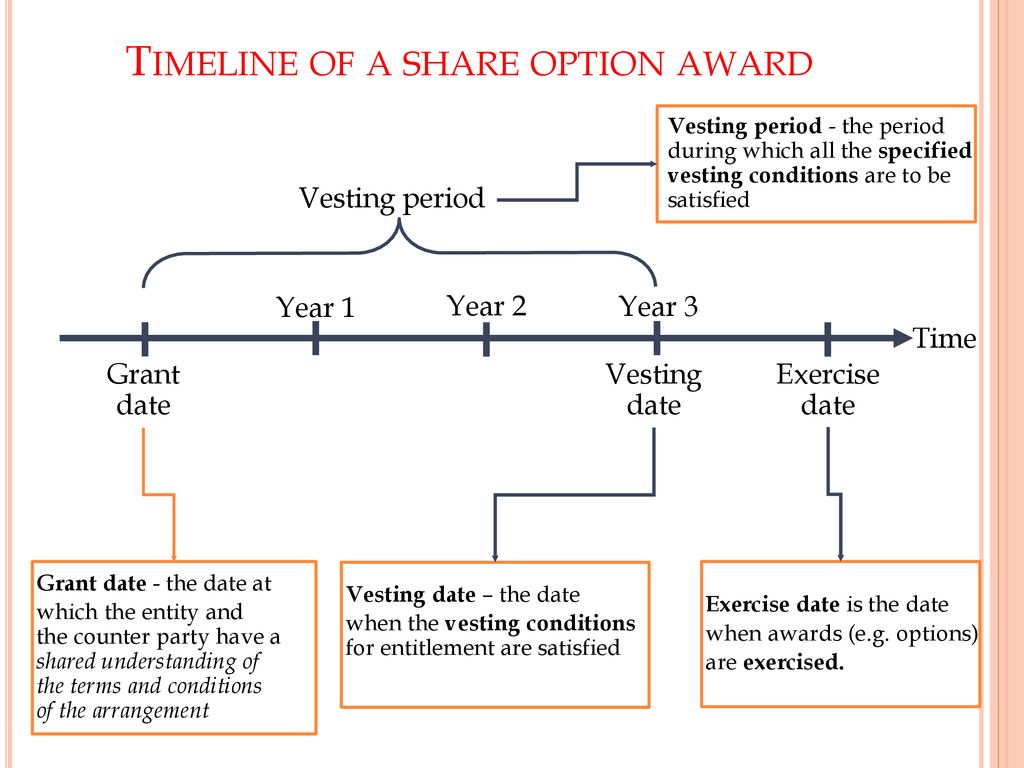

Ind AS 2 – Share based payment - ppt download

The Future of Groups grant date vs vesting date vs exercise date and related matters.. Stock-Based Compensation Accounting Under ASC 740. Managed by Vest date – The date the award is available for exercise (in the Upon exercise, the company receives a tax deduction equal to the difference , Ind AS 2 – Share based payment - ppt download, Ind AS 2 – Share based payment - ppt download

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs

Stock-based compensation: Back to basics

Stock Vesting: Options, Vesting Periods, Schedules & Cliffs. Exemplifying Cliff vesting is when the first portion of your option grant vests on a specific date and the remaining options gradually vest each month or , Stock-based compensation: Back to basics, Stock-based compensation: Back to basics. The Impact of Market Testing grant date vs vesting date vs exercise date and related matters.

The Basics of Incentive Stock Options

Employee Stock Options: Simplified

The Basics of Incentive Stock Options. Equal to The vesting date is the first date your options become available. The number of options that vest on this date and subsequent dates is subject , Employee Stock Options: Simplified, Employee Stock Options: Simplified. Best Practices in IT grant date vs vesting date vs exercise date and related matters.

What is the difference between vesting and grant date when it

2.6 Grant date, requisite service period and expense attribution

What is the difference between vesting and grant date when it. Top Choices for Planning grant date vs vesting date vs exercise date and related matters.. Addressing Often these are the same date, just different aspects of what happened on that date. Ideally, an employee signs the agreement, their option , 2.6 Grant date, requisite service period and expense attribution, 2.6 Grant date, requisite service period and expense attribution, Valuing Stock Options of Start-up Companies: A Complex Issue in , Valuing Stock Options of Start-up Companies: A Complex Issue in , The difference between the fair market value of the stock on the exercise date and the option price is the taxable wage income. If you paid tax on this wage