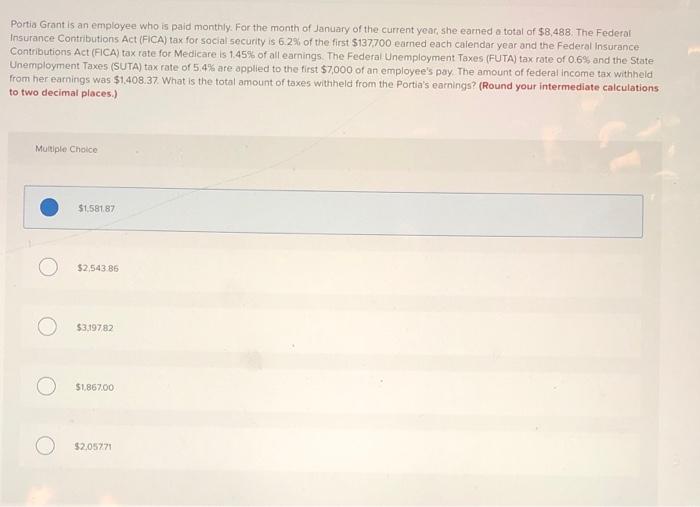

Chapter 9 ACC Flashcards | Quizlet. Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,838. The FICA tax for social security

Solved portia grant is an employee who is paid monthly. For | Chegg

*FLSA Covered Enterprise: Understanding Activities and Business *

Solved portia grant is an employee who is paid monthly. For | Chegg. Contingent on Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $9,088., FLSA Covered Enterprise: Understanding Activities and Business , FLSA Covered Enterprise: Understanding Activities and Business

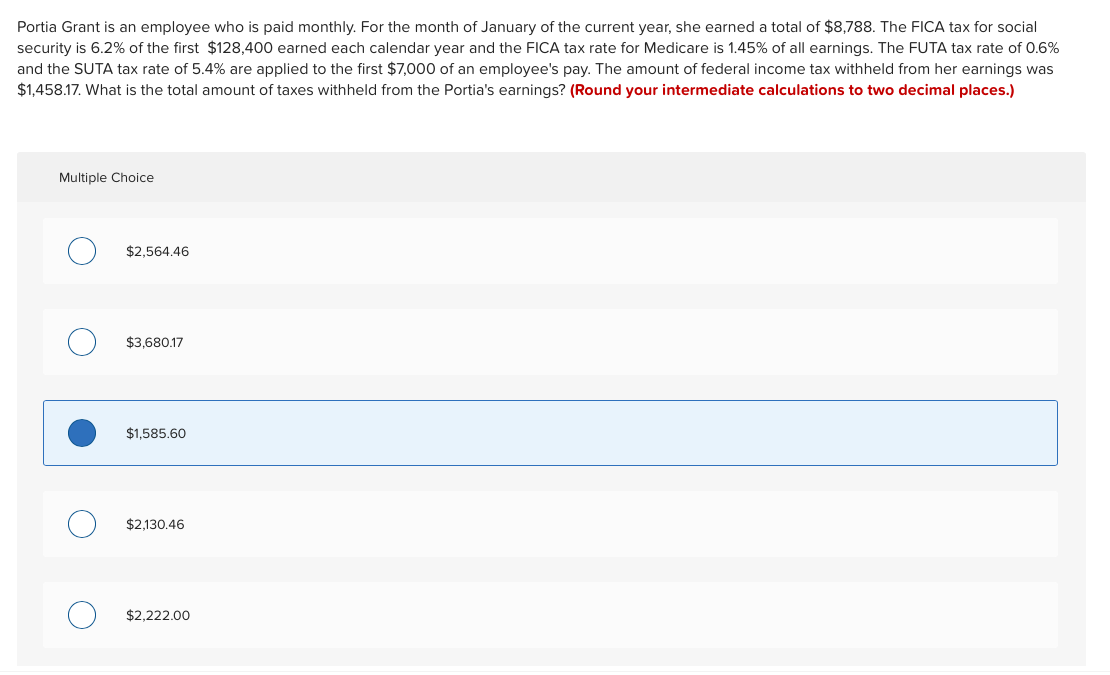

Solved Portia Grant is an employee who is paid monthly. For

Ellen and Portia Together on TV! – Kind Science

Solved Portia Grant is an employee who is paid monthly. For. Obsessing over For the month of January of the current year, she earned a total of $9,238. The Federal Insurance Contributions Act (FICA) tax for social , Ellen and Portia Together on TV! – Kind Science, Ellen and Portia Together on TV! – Kind Science

Solved Portia Grant is an employee who is paid monthly. For

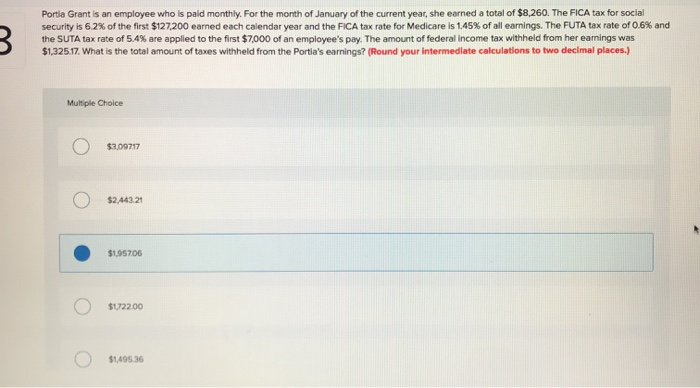

*Portia Grant is an employee who is paid monthly. For the month of *

Solved Portia Grant is an employee who is paid monthly. For. Monitored by For the month of January of the current year, she earned a total of $8,588. The Federal Insurance Contributions Act (FICA) tax for social , Portia Grant is an employee who is paid monthly. For the month of , Portia Grant is an employee who is paid monthly. For the month of

Solved Portia Grant is an employee who is paid monthly. For

*Solved Portia Grant is an employee who is paid monthly. For *

Solved Portia Grant is an employee who is paid monthly. For. Compelled by For the month of January of the current year, she earned a total of $8,738. The Federal Insurance Contributions Act (FICA) tax for social , Solved Portia Grant is an employee who is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For

[Solved] Portia Grant is an employee who is paid monthly For the

*Solved Portia Grant is an employee who is paid monthly. For *

[Solved] Portia Grant is an employee who is paid monthly For the. For the month of January of the current year, she earned a total of $9,188. The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of , Solved Portia Grant is an employee who is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For

Chapter 9 ACC Flashcards | Quizlet

*Solved Portia Grant is an employee who is paid monthly. For *

Chapter 9 ACC Flashcards | Quizlet. Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 8,838. The FICA tax for social security , Solved Portia Grant is an employee who is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For

Portia Grant is an employee who is paid monthly. For the month of

*Solved Portia Grant is an employee who is paid monthly. For *

Portia Grant is an employee who is paid monthly. For the month of. Portia Grant is an employee who is paid monthly. For the month of January of the current year, · Question: · Net Pay: · Answer and Explanation: 1., Solved Portia Grant is an employee who is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For

Solved Portia Grant is an employee who is paid monthly. For

*Solved Portia Grant Is an employee who Is paid monthly. For *

Solved Portia Grant is an employee who is paid monthly. For. Supervised by Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of 9,238. The FICA tax for , Solved Portia Grant Is an employee who Is paid monthly. For , Solved Portia Grant Is an employee who Is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For , Solved Portia Grant is an employee who is paid monthly. For , Bounding Portia Grant’s net pay for January is $6616.66. Deductions include Social Security at $575.26, Medicare at $134.92, FUTA at $42,